In the spirt of keeping our industry partners apprised of Westcove’s initiatives, successes, and coverage areas, our team is excited to share our 2021 firmwide update. In the following paper, we will provide a short description for each completed transaction that we served as an exclusive advisor to and the specific sub-industries within the healthcare continuum that our team continues to research and remain active in. We would like to thank our clients, third-party partners, and the strategic partners and financial sponsors we have worked with throughout 2021 and 2022. These various groups of stakeholders have helped make our first year incredibly meaningful and successful and have set us up for an exciting 2022 and beyond.

One of our core principles at Westcove is to be selective in the mandates we engage. This was of particular importance in our first full year of operations. This stems from a philosophy of providing curated services to each and every client. We are grateful to each client that offered our team an opportunity to represent them in their respective transactions.

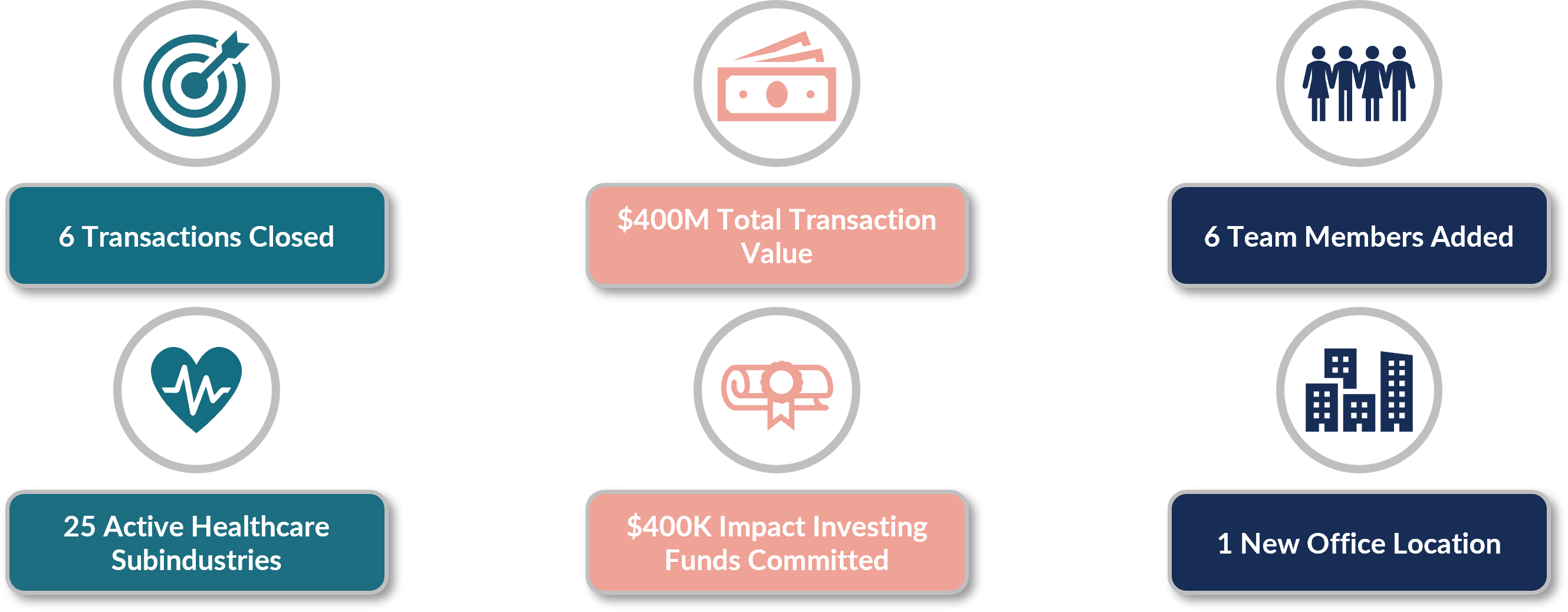

In the second half of 2021, we closed six transactions across a variety of subindustries within healthcare services – medical diagnostic imaging, radiology, non-skilled and intellectual disability home care services, medical device distribution, direct primary care provider, government reimbursed home care services, and urgent care. Please see below for our consummated transactions:

Below, we have provided brief overviews of our closed transactions to date:

Westwood Open MRI’s Acquisition by Rezolut (backed by Sunny River Management)

Westwood Open MRI (“Westwood”) is one of the premier providers of outpatient MRI services in the greater Los Angeles region. Westwood performs over 7,000 MRI scans per year, including functional and structural MRI and MRA for musculoskeletal, neuro, and body imaging. Westwood’s open MRI facilities can accommodate a wide range of patients, including claustrophobic and obese patients, and has advanced imaging capabilities for functional MRI and prostate exams. Its advanced capabilities, its ability to accommodate patients with special requirements, and its patient-centered approach have made Westwood a point of reference for satisfied patients and physicians.

Rezolut, a high growth medical imaging business with presence across six states and backed by Sunny River Management, a private family investment firm, emerged as the ideal partner in a competitive process for Westwood. Westwood’s location and advanced capabilities were key in expanding Rezolut’s pursuit to provide quality patient services in Los Angeles.

24 Hour Homecare’s Partnership with Team Services Group (backed by Alpine Investors)

24 Hour Home Care (“24 Hour”) provides high-quality, round-the-clock, in-home personal care to seniors and individuals (adults and children) with intellectual and developmental disabilities (“I/DD”). 24 Hour was established on the belief that seniors and those with I/DD needs deserve the best possible personal care while living in their own homes, on their terms. 24 Hour provides senior care services across California, Arizona and Texas and provides care to individuals with I/DD disabilities across California through its robust relationship with the California Department of Developmental Services and a network of 21 Regional Centers across the state. The Company employs more than 11,000 caregivers who provide care to more than 13,000 clients and families.

After a competitive process, TEAM Services Group, a confederation of home care brands backed by private equity firm Alpine Investors, emerged as the optimal partner for 24 Hour. TEAM’s organizational infrastructure and access to growth capital allows 24 Hour to expand into new geographies while simultaneously increasing its foothold within existing markets.

Eco Sound Medical Services’ Acquisition by Federated Healthcare Supply

Eco Sound Medical Services (“Eco Sound”) has served communities across the healthcare continuum in assisted living, long-term-care, post-acute care, behavioral health, continuing care retirement communities, and residential care homes for over 25 years. The Company distributes products to over 6,000 customers across six states via a network of 200 manufacturers. Eco Sound’s exceptional customer service model and deep industry relationships have established it as a trusted source for top-of-the-line, brand-name healthcare products from national and independent brands and manufacturers.

With the integration of Eco Sound, Federated Healthcare Supply Holdings, a leading national provider of healthcare supplies, expanded its national footprint in the Western United States.

R-Health’s Acquisition by Everside Health (backed by NEA)

R-Health provides direct primary care services to self-funded employers via a tech-enabled platform. The Company sought to change the way patients engage with their doctors by removing barriers to care, while simultaneously reducing overall healthcare spend for employers via direct costs and absenteeism. R-Health served its clients through an optimal network of onsite, near site and telehealth offerings across New Jersey and Pennsylvania. In addition, the Company was one of the exclusive direct primary care providers to the New Jersey State Health Benefits Program, a program that served over 500,000 lives.

R-Health sought to align with a partner that would allow the Company to fulfill its mission on a larger scale. In a competitive and efficient process, Everside was able to separate itself from competitors not only through valuation, but through its patient-focused, care-obsessed, technology-driven healthcare delivery model. The model aimed to align incentives to benefit the patient, the physician and the benefit provider, all while reducing the total cost of care providing immense synergies to our client, R-Health.

Community Care Systems Acquisition by Help at Home (backed by The Vistria Group and Centerbridge)

Community Care Systems was the second largest Illinois-based, government-reimbursed homecare Company. The Company employed over 2,700 field employees that served over 5,900 clients across 13 offices. Through its emphasis on top-quality and specialized training, the Company prided itself on delivering high quality services and sought to align with an acquiror delivering services of excellence.

For more than 45 years, Help at Home, a leading provider of relationship-based home care to seniors and persons with disabilities, provided person-centered care that helped individuals remain in their homes. Headquartered in Chicago, Illinois, the Company provides in-home, community-based care in 13 states across 169 locations via 30,000 highly trained, compassionate caregivers to over 67,000 clients.

Urgent Care Plus’ Acquisition by Carbon Health (backed by Blackstone)

Urgent Care Plus was a leading urgent and primary care provider based in the fast-growing Long Beach, California marketplace. The Company aimed to be the preferred medical care provider in its core geography and maintained a staff that is made up of experienced, licensed medical assistants and x-ray technicians who assist the physicians in providing care. The Company sought a strategic partner to help elevate its care services through marketing and technological improvements.

Carbon Health, a tech-enabled, venture-backed urgent care, primary care, mental health, women’s health, and LGBTQ health care provider acquired Urgent Care Plus to solidify its presence in Southern California. Carbon Health, headquartered in San Francisco, California, operated clinics across 10 states, and had over 40 locations in California alone.

In addition, to the above closed transactions we are in various stages of transaction processes with several other clients across healthcare services including – cardiology, gastroenterology, ENT, plastics / aesthetic surgery and ophthalmology practitioners, ABA / early intervention therapy, cord blood banking, home care, medical distribution, life sciences and specialty pharmacy. Westcove is looking forward to guiding our clients to successful closes in each instance.

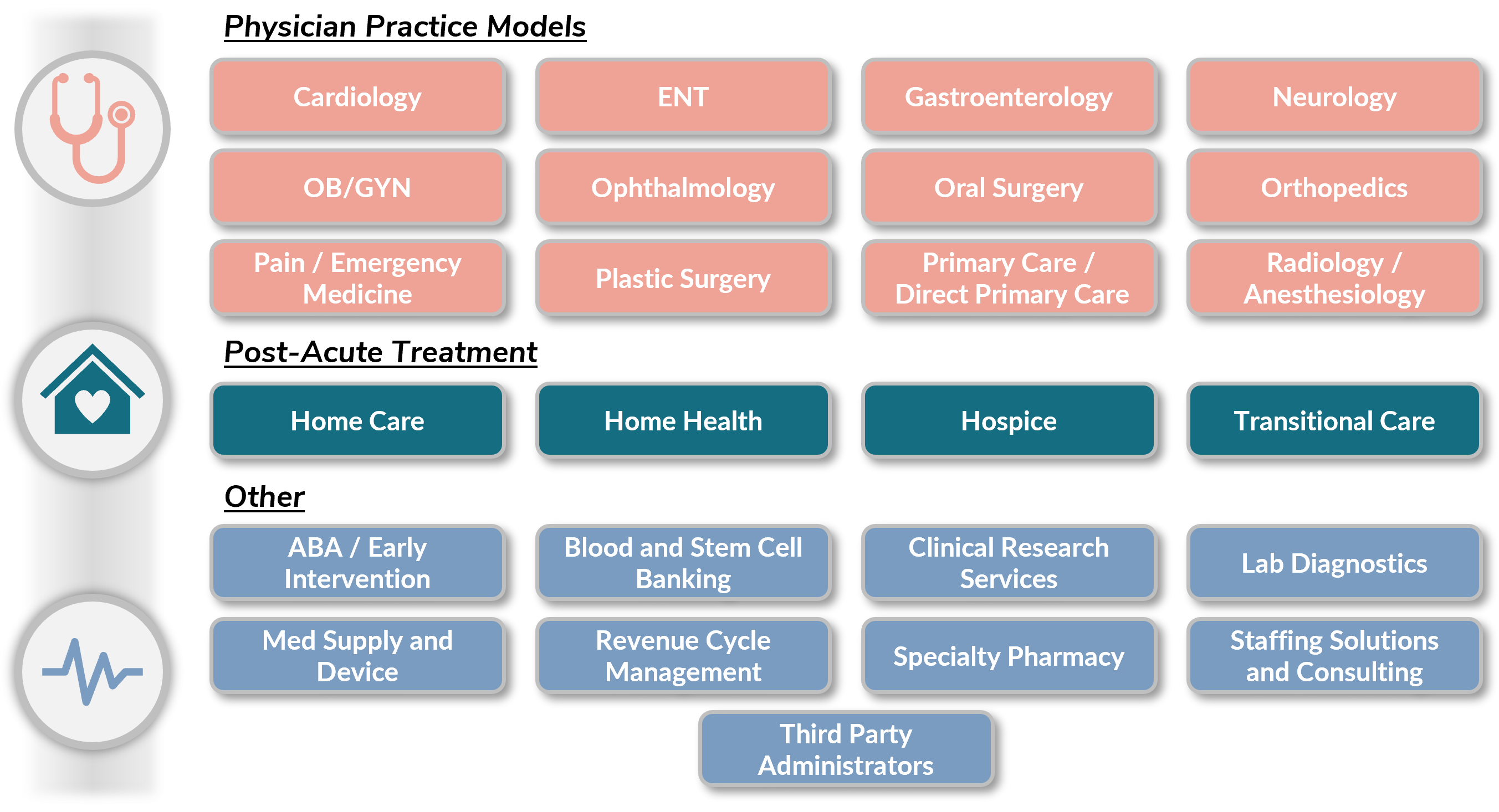

In addition to current and past clients, Westcove is active in a number of coverage healthcare service subsectors. Our team aims to be an educational resource to founder-operators, financial sponsors and third parties in each of these sub-sectors.

As part of Westcove’s principles, a portion of all revenue generated by the Company is allocated to impact investing geared towards aiding underrepresented individuals and entrepreneurs. In 2021, Westcove generated over $400,000 in funds and allocated those funds to the below opportunities: