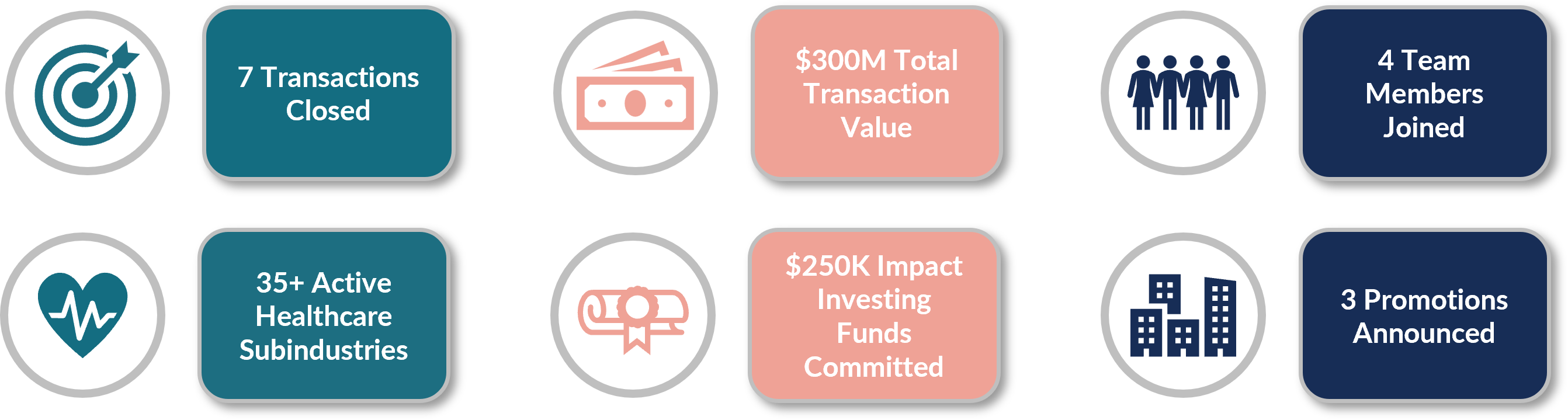

As we reflect on a highly successful 2022 for Westcove Partners, we are excited to keep our industry partners apprised of our firm’s accomplishments, ongoing initiatives, and active coverage areas. With the help of our clients, third-party partners, and the strategic partners and financial sponsors we have had the pleasure of working with, Westcove has expanded upon the success of our inaugural year with internal and market-wide achievements. Internally, Westcove has expanded its team, promoted from within, and transitioned to a new office in Century City, Los Angeles. On a market-wide level, the Company closed seven transactions across a variety of healthcare services verticals, been nominated for the M&A Boutique Investment Bank of the Year, and won the Small U.S.-based M&A Transaction of the Year by The M&A Atlas Awards. The Westcove team is well-positioned and excited to continue this momentum into 2023 and beyond. The ensuing overview provides a summary of each of the seven transactions we have advised to completion, as well as insight into our ongoing coverage areas, firmwide developments, and the accomplishments of our team.

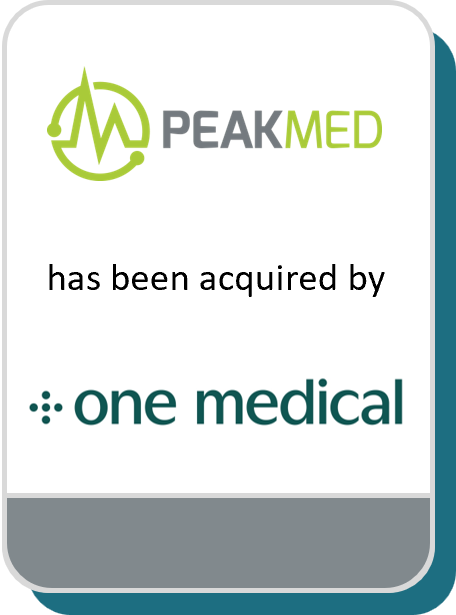

The M&A Atlas Awards | Americas in Q4 of 2022 announced that Westcove has been recognized across two major annual categories; Small U.S.-based M&A Transaction of the Year and Boutique M&A Healthcare Investment Bank of the Year. Westcove won the honor of Small U.S.-based M&A Transaction of the Year for its white-glove approach serving as the sole sell-side financial advisor to PeakMed LifeCenter’s (“PeakMed”) in its acquisition by One Medical. Additionally, Westcove Partners was nominated for the Boutique M&A Healthcare Investment Bank of the Year award for 2022 due to its client-focused approach, tailored processes, and the seven impressive deals it closed in the calendar year.

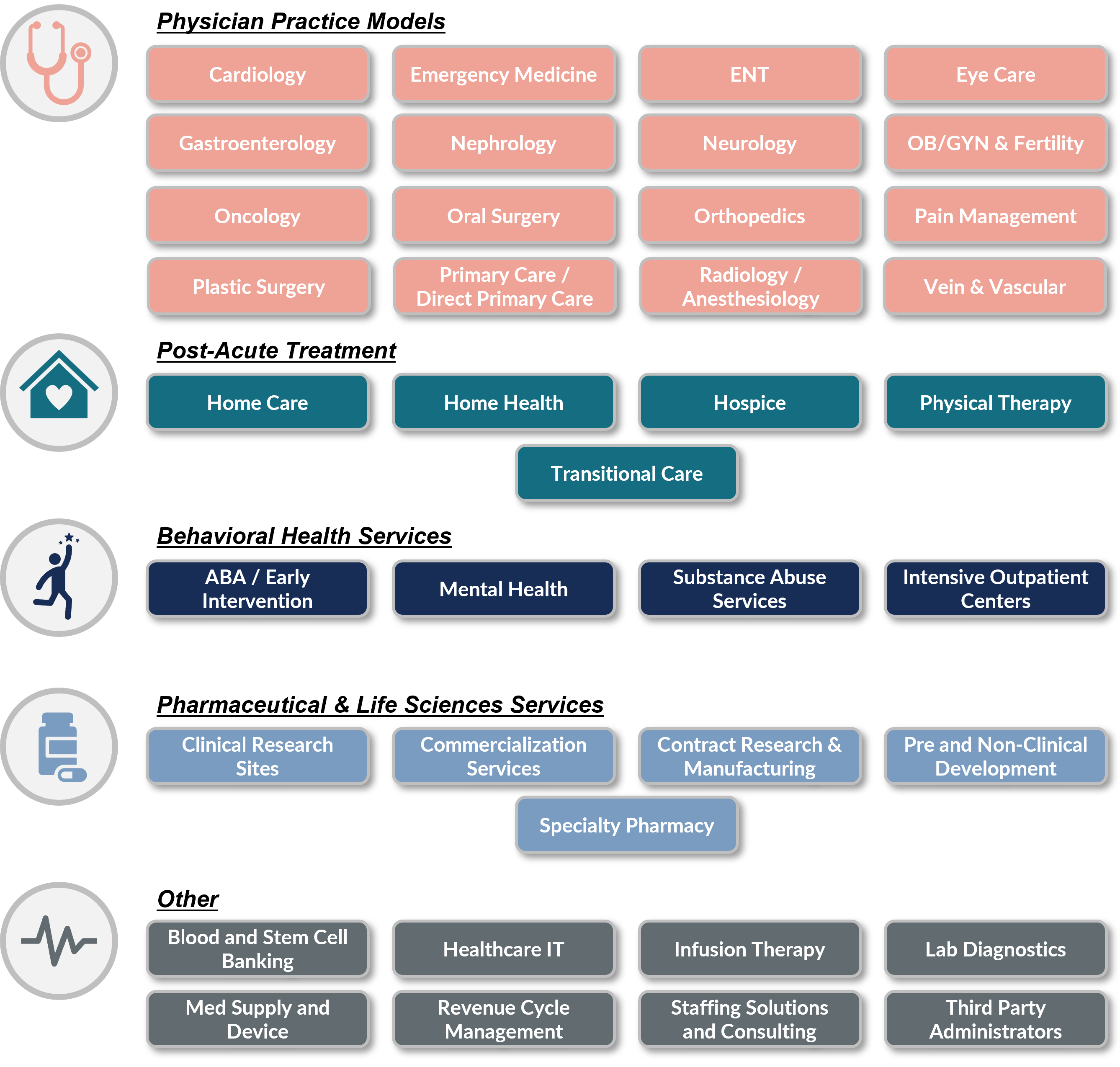

In addition to current and past clients, Westcove is actively covering 35+ healthcare service subsectors. Our team aims to be an educational resource to founder-operators, financial sponsors and third parties in each of these sub-sectors.

As part of Westcove’s principles, a portion of all revenue generated by the Company is allocated to impact investing geared towards aiding underrepresented individuals and entrepreneurs. In 2021, Westcove generated approximately $250,000 in funds and allocated a portion of those funds to Chezie:

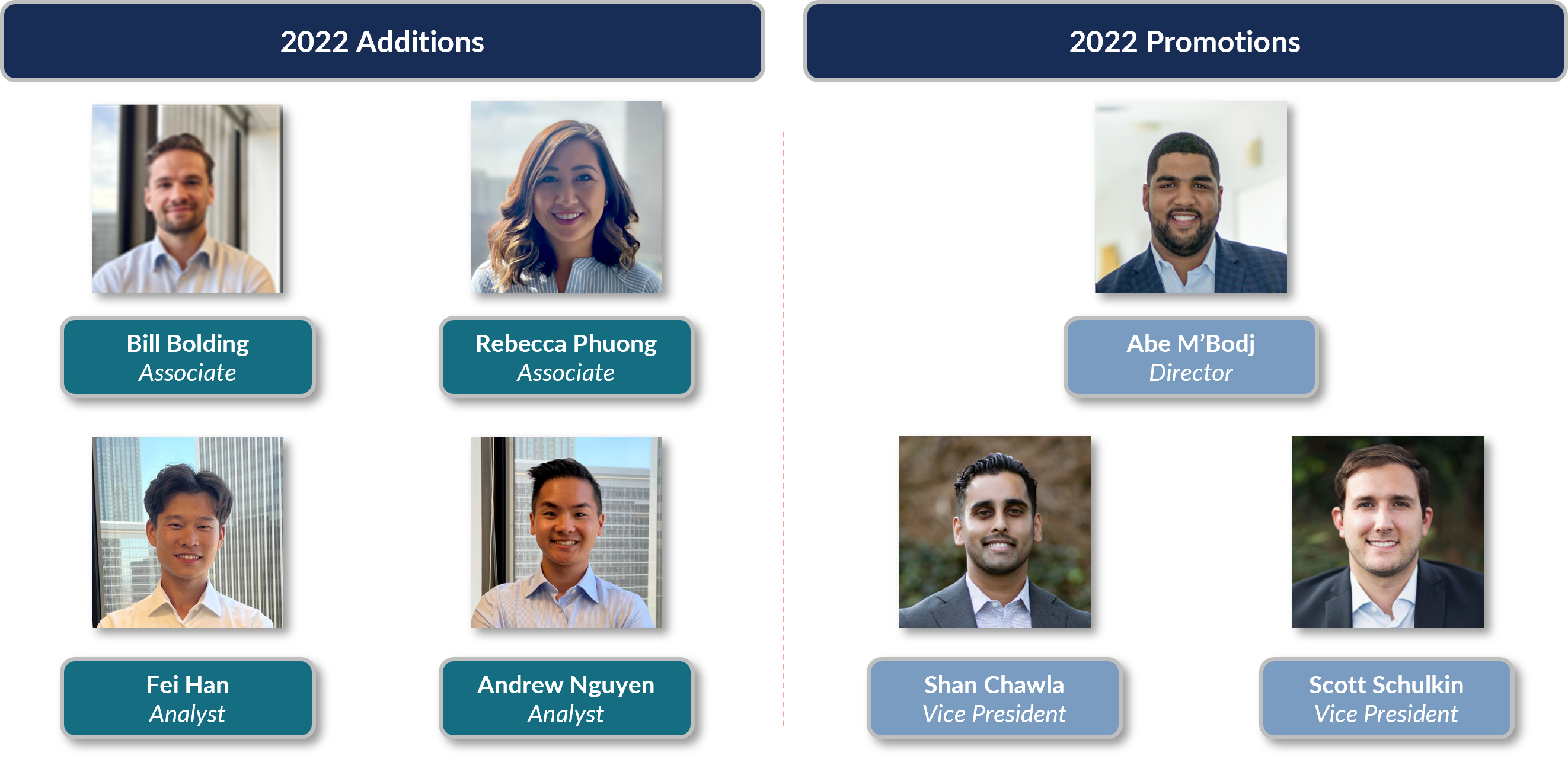

Westcove remained active in hiring and developing talent internally in 2022. The Company fosters a culture of accountability and growth, which has helped it expand from three individuals in January 2021 to nine presently. Westcove is proud of the growth that each team member has shown throughout 2022 and is pleased to announce the following additions and promotions to the team: