The Direct Primary Care (“DPC”) industry remains one of the most sought-after industries for investment by both

private equity sponsors and strategic acquirers looking to consolidate or diversify their operations. There are several

factors to consider that are currently driving consolidation within the direct primary care industry at substantial

transaction multiples, all of which are likely to continue in 2022 and beyond.

First and foremost, the DPC model, in contrast to the traditional primary care model, aims to improve the physician

experience that is currently contributing to a shortage of primary care physicians in the US, which in turn supports

better care for patients. Growing physician frustration surrounding the traditional primary care model creates an

opportunity for DPC companies to retain physicians in the primary care space, as the DPC model provides less

personal financial and administrative burden for a primary care physician and more convenience and flexibility in

total hours worked. Other notable trends driving the growth in this industry include the increasing national

healthcare spend in the US, which poses an opportunity for DPC companies to receive increased demand for services

and finally, increased regulatory and employer support for access to direct primary companies and their services.

Presently, there are five private equity-backed platforms. Westcove believes this figure may grow to eight to ten over the next one to three years before existing platforms pursue secondary recapitalizations (“second bites of the apple”). In addition to new private equity sponsors seeking platform investments, Westcove expects existing platforms will continue to expand via add-on acquisitions of smaller practices in local and regional markets to broaden and solidify their market presence across the United States.

In the following white paper, Westcove will highlight each of these trends and detail why the near future may offer a

compelling opportunity for direct primary care shareholders and executives to consider a capital raise, acquisition, or

private equity investment to help fuel growth in their Companies.

Direct Primary Care vs. Traditional Primary Care

Prior to discussing the trends driving consolidation at record-breaking valuation multiples, it’s important to note the

differences between the traditional primary care system and the direct primary care model.

Traditional primary care providers rely on a fee-for-service payment model, where physicians are paid based on the

volume of patients treated rather than the value of the care provided. With this traditional model, a patient often

leaves the doctor’s office without knowledge of what their insurance will be billed. After deductibles or co-pays are

applied and discounts are negotiated between the provider and insurance company, the patient then receives an

explanation of what they’re expected to pay for the visit. This fee-by-service billing makes it difficult for patients, and

even providers, to understand the cost of care and appropriately prioritize care over income. Thus, this care model

often leads to issues such as higher costs for patients, lower levels of patient satisfaction, and worsening health

outcomes.

Conversely, the DPC model employs a continuous and relationship-based system between the physician and the

patient. Direct primary care is a financial agreement between the healthcare providers and the patient, which aims to

remove insurance providers in the transaction. In contrast to fee-for-service models, DPC models look to utilize the

most effective parts of value-based care, such as the use of technology and increased physician satisfaction, for the

patients or self-funded employers they serve, ultimately driving successful outcomes of their respective patient

populations. Patients usually get 24/7 access to doctors as direct primary care patients are usually able to access

same-day or next-day visits, given the higher level of emphasis on patient satisfaction. Tele-health options are also

frequently implemented such as the option to call, email, video call, or text their healthcare provider. Self-funded

employers have increasingly adopted direct primary care models for use by their employees due to the propensity of

DPC models to increase workplace efficiency and productivity by decreasing sick leave and lower quality work due to

illness. Rather than fee-for-service billing or other volume-based incentives, patients or the employers that offer DPC

services are charged a flat monthly fee.

Direct Primary Care vs. Traditional Primary Care

Co-pays, out of pocket costs, and third-party billing are not typically part of DPC models, thus patients and the

employers that encourage their employees to utilize DPC services are able to better estimate overall healthcare

spend. The DPC model simultaneously focuses on continuous wellness and preventive care for patients, rather than

care after the fact. DPC models ensure that patients are able to access routine primary care and mitigate the risks of

down-the-line health complications. DPC models, also effectively address the inefficient use of physicians’ time on

administrative tasks, which is better utilized concentrating on patients’ needs without the burden of payor-driven

demands. Lastly, DPC models are able to lower overall healthcare spend for patients and for self-funded employer

plans by utilizing advanced data aggregation and analytics. Many DPC companies utilize proprietary or customized

electronic medical record software in conjunction with patient-centric software that better tracks patient utilization

of services, patient adherence to treatment, overall progress and ultimately outcomes of treatments. Analyzing these

data and focusing on the most effective treatments allows DPC-models to more effectively manage a population’s

health, reducing overall healthcare spend for the patient or self-funded employers.

As stated previously, DPC companies, primarily utilize a subscription and relationship-based sales model that allows

consumers to receive continuous care. With the industry being nascent, the pricing structure varies from physician to

physician and company to company but can be put into a relative range. The average adult fee for membership is

approximately $82.86 a month or $994.32 a year. In higher cost of living areas like San Francisco and New York,

companies can charge up to $175 per month. Over 82% of family memberships cost around $50 to $225 per month.

These Companies often tailor their clinics and prices to their specific geographic and target market demographics.

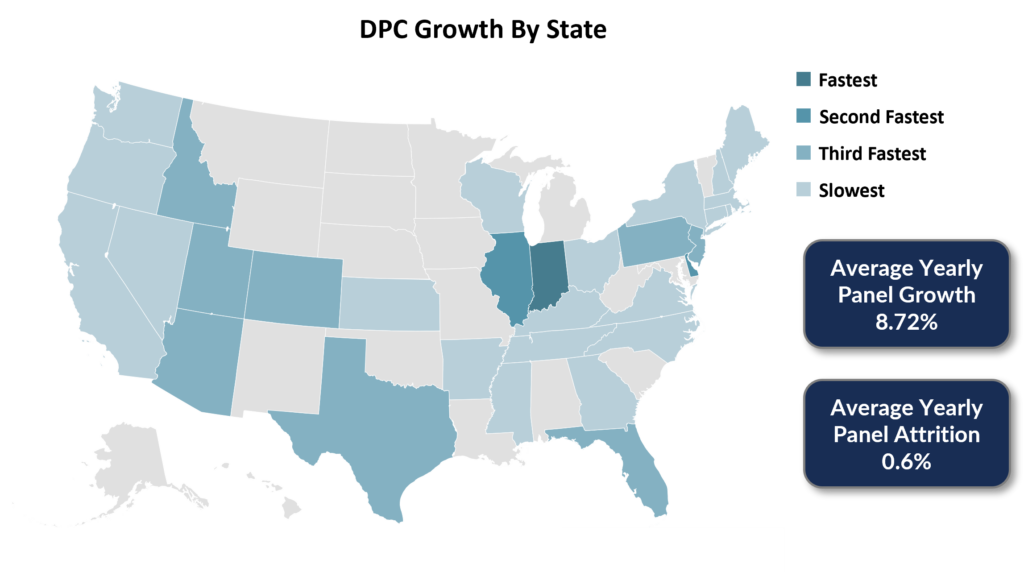

Across the country, there are approximately 1,000 DPC practices in 48 states who serve over 300,000 patients. The

DPC industry is still in its infancy as only 4.5% of all physicians, or roughly 20,000, have adopted the DPC model or

are employed by DPC companies.

Increasing Physician Frustration & Burnout

Growing Trends Towards Preventative Care

Chronic diseases are the leading cause of death in the US and the primary drivers of the country’s $3.5 trillion in

annual health care costs. Preventative care offers a long-term solution for this health concern. The traditional

primary care model focuses on solely addressing urgent medical issues and “sick care.” However, the DPC model

prioritizes routine care which involves regular check-ups to detect health issues before they turn into major medical

issues.

Trends Towards Value Based Payments Over Fee-For-Service

The shift away from fee-for-service payments is further driven by governmental trends to build on the regulations like

the Affordable Care Act by doubling down on alternative payment models and mandatory payment changes.

Specifically, it the Department of Health and Human Services will make fee-for-service less attractive and push

mandatory alternative payment models, providing an opportunity for value-based DPC models to grow.

In December 2020, Senators Bill Cassidy, Doug Jones, Jerry Moran and Jeanne Shaheen introduced legislation to

lower the cost of healthcare and expand patients’ access to their primary care providers. From this legislation, DPC

providers are able to expand their reach to patients. As of 2020, Direct Primary Care laws have been passed in 32

states with pending legislation in 12 states. These laws generally define DPC as a medical service outside of state

insurance regulation and offer varying levels of consumer protection. For example, in 2016, DPC provider R-Health, a

transaction recently completed by Westcove, was awarded a contract to provide services to members of the New

Jersey State Health Benefits Program (“SHBP”). There has also been an increasing number of employers offering

employees DPC services. This is fuelled by greater awareness on overall healthspend both in time and money. In

addition to managing potential catastrophic claims in the future, employers can achieve up to a 20% reduction in

total healthcare costs by offering DPC services.

The above discussion shows the inherent growth and interest both by sponsors and strategics in the DPC industry.

Below are select examples of Direct Primary Care transactions completed:

Private-equity firms traditionally have invested in healthcare groups that offer high-reimbursement potential

(dermatology, pain management and dentistry). However, with these specialty practices increasingly becoming more

expensive, private equity firms have begun to look at primary care practices. These firms prioritize primary care

groups that can demonstrate better quality and lower costs in managing medically complex patients which will be

valuable in a modern healthcare system that emphasizes cost-effective, efficient and preventative care. Below are

examples of private equity transactions in the Direct Primary Care space:

Below are examples of Direct Primary Care companies that have gone public at attractive valuations: