Hospice Industry Insights

(2021 – Year in Review)

Market Trends and M&A Activity

January 2022

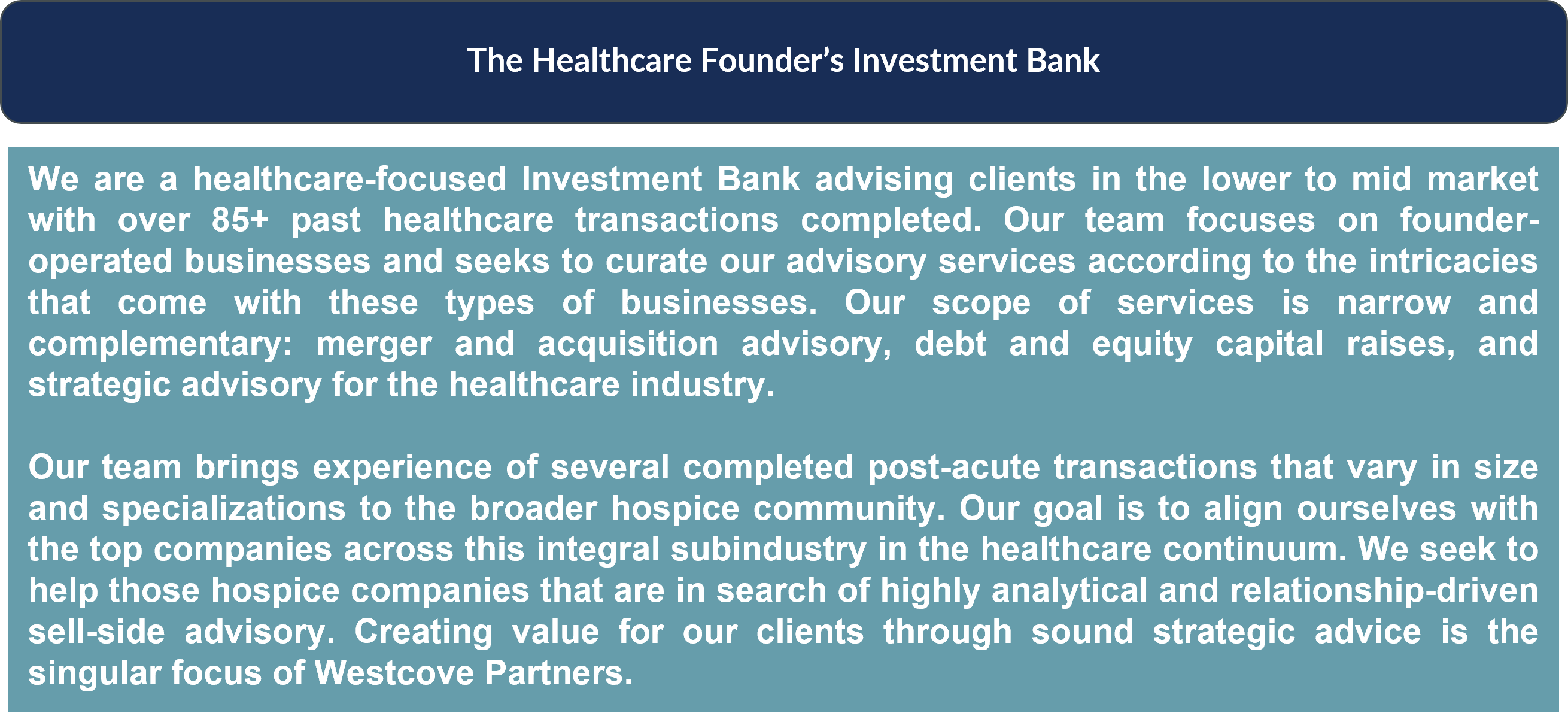

Introduction

Throughout 2021 the hospice industry remained one of the most sought-after healthcare service industries for investment by both private equity sponsors and strategic acquirers looking to consolidate or diversify their operations. The primary trends that fueled the industry’s consolidation remained the same as before – market fragmentation, low capital expenditures, and an increasing demand for in-home services. These trends will continue to persist well into 2022 and beyond, especially as the effects of the COVID-19 pandemic continue to diminish.

Regulatory trends coupled with continued demographic shifts like the rise of hospice utilization through individual choice and changing physician referral dynamics have also created an increase in demand for hospice acquisitions. High-quality hospice businesses continue to draw interest from capital-rich financial sponsors and strategic players thereby increasing multiples paid for these businesses.

In the following piece, Westcove will highlight each of these trends and detail why the first half of 2022 may offer a compelling time for hospice shareholders and executives to consider a capital raise, acquisition, or private equity investment.

Consolidation within the Industry

Prior to discussing the trends that continue to drive consolidation at record-breaking valuation multiples in 2022, it’s important to note the significant transactions that have occurred during 2021 and thus far in 2022. Despite the impact of COVID-19, hospice transactions have continued at a flurry that shows little signs of slowing down in 2022. Acquirers have prioritized well-managed and productive organizations with leading locations in their local communities. Many of the transactions consummated in 2021 have been strategic acquisitions by the industry’s largest players:

M&A Activity in the Hospice Industry

Trends in Hospice Utilization

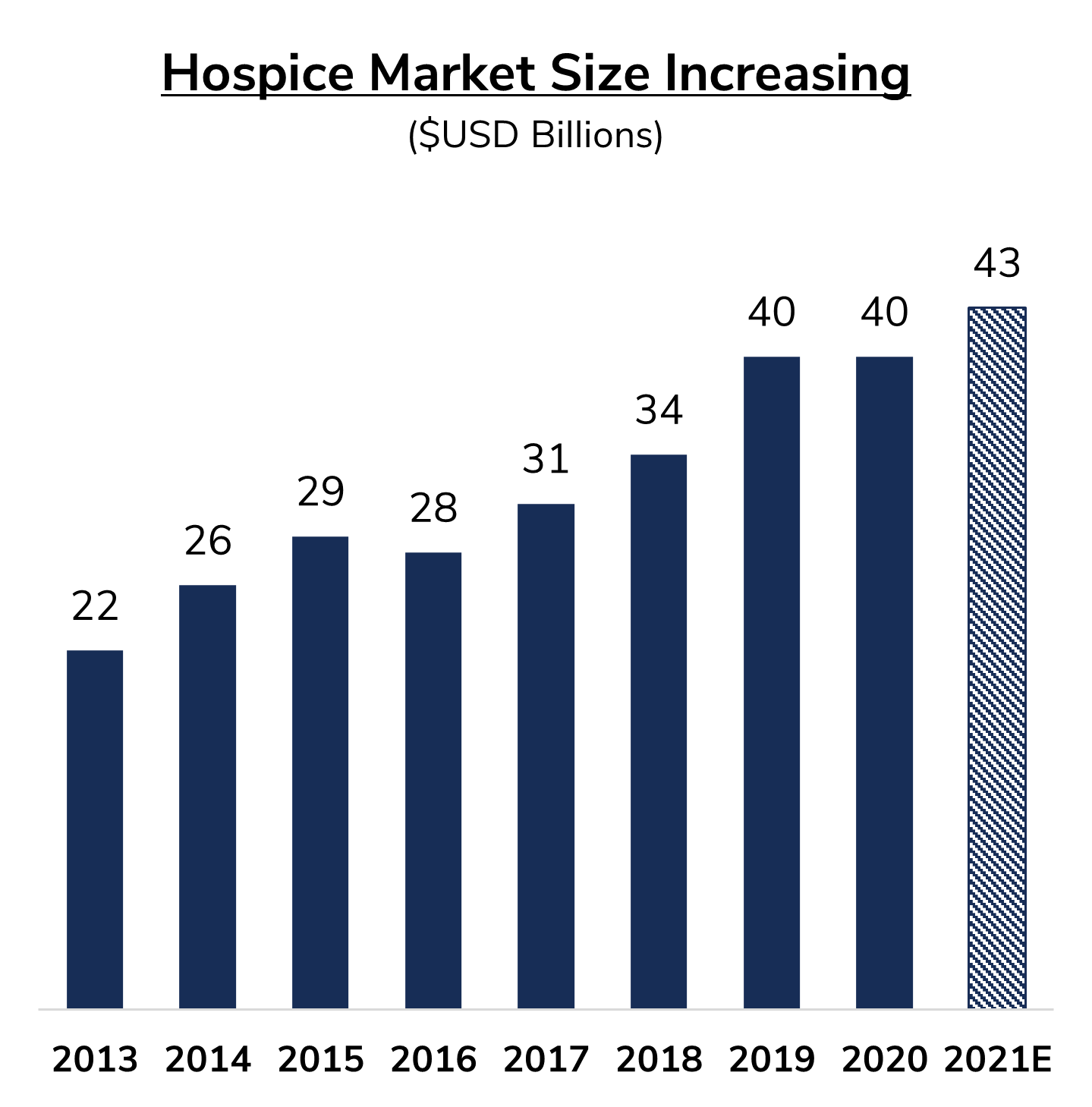

The greatest macroeconomic tailwind driving increased multiples for hospice providers continues to be the rise in hospice utilization. The total average daily census for the hospice industry has increased from approximately 234,000 in 2011 to approximately 317,000 in 2019, an increase of over 35%. Simultaneously, the hospice market size has increased 82% on a compound annual rate from 2013 to 2020. There are a number of factors driving this increase in utilization and market size, but the primary drivers are the aging U.S. population and the increasing acceptance and adoption of hospice services by both referring physicians and patients.

Aging Population

The average age of the US population continues to increase at a steady rate. Today, there are 46 million adults in the US that are 65 years or older. By 2050, the number of adults over the age of 65 is projected to double to approximately 90 million. Between 2020 and 2030, the number of elderly is projected to grow by 18 million. By 2030, 1 in 5 Americans is projected to be 65 years or older. This will lead to a direct increase in hospice utilization, especially for sunbelt states as the overall population, specifically the elderly population, prefers warmer climates.

Increased Acceptance and Adoption

Hospice providers have seen an uptick in acceptance by both patients and physicians. Patients have an increased understanding of the benefits of hospice services as a means to improve quality of life in the final stages of their lives. Moreover, the overall interdisciplinary team that provides care for the patient covers a variety of specialties that would not likely be available to a patient otherwise, this realization has driven adoption by the patient population. Hospice services of particular importance to patients have been palliative care, spiritual care, family access, and respite care for family and bereavement care.

As patients have increased awareness and adoption of hospice care, physicians in turn have increased referrals and adoption of hospice services for their patients. Physicians have found benefits in referring patients to hospice care like decreased re-hospitalization rates and a clear increase in end-of-life quality. There have been numerous studies that show the substantial benefits of hospice care. For example, a Journal of the American Medical Association published study completed in 2014 found that poorprognosis cancer patients enrolled in the Medicare Hospice Benefit experienced considerably lower rates of re-hospitalizations, intensive care admissions, invasive procedures, and saw significantly lower overall health care costs during the final years of life, compared to non-hospice patients.

2021 Regulatory Changes for Hospice Providers

Medicare Advantage “Carve-in”

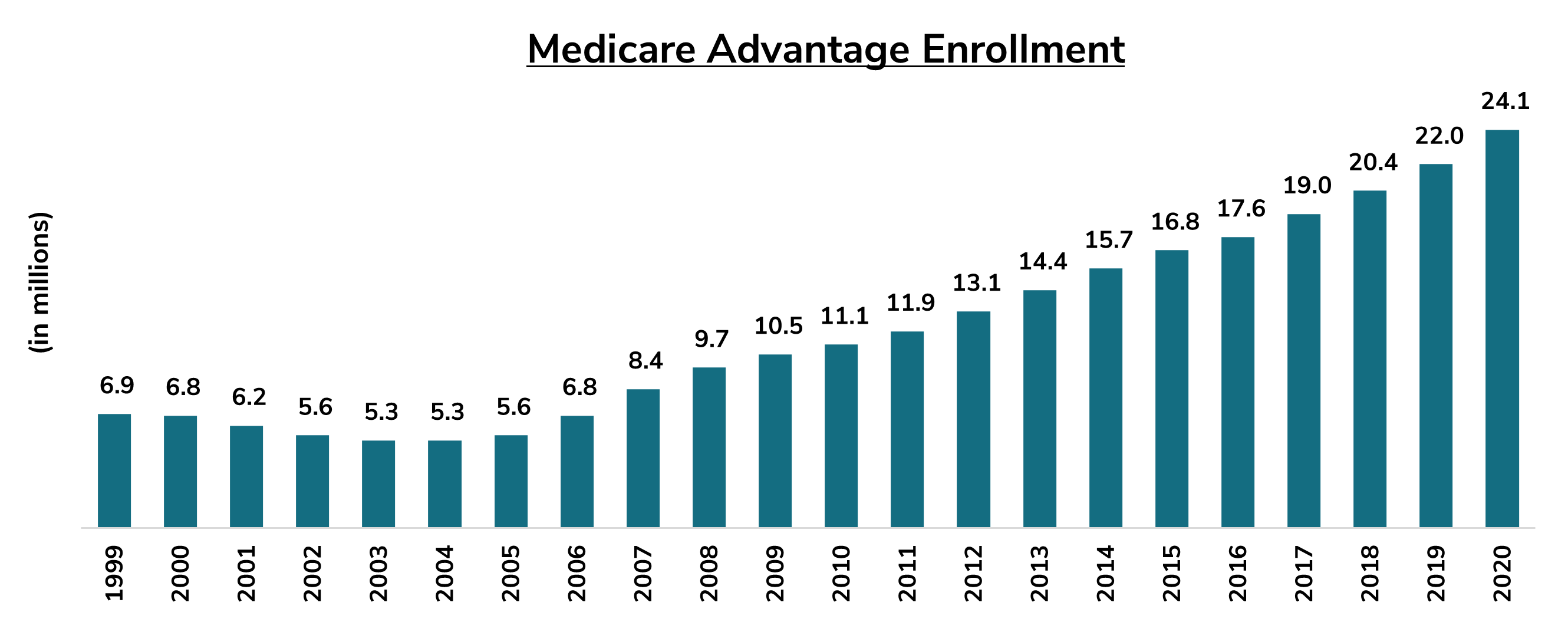

In 2021, Centers for Medicare and Medicaid Services (“CMS”) expanded coverage of hospice services for patients enrolled in Medicare Advantage plans as part of a “carve-in” provision. All four levels of hospice care are now covered. CMS hoped that this provision would help eliminate inefficiencies and lapses in coverage and care caused by the current system.

The benefits of the hospice “carve-in” to Medicare Advantage will continue to be felt well into 2022 as the “carve-in” is slated to roll out over a four-year period that was initiated in January 2021. The “carve-in”, effectively aligns the interests of all immediate stakeholders: patients, hospice providers, and Medicare Advantage providers. 12 months after the initial rollout of the “carve-in” policy, the hospice industry has seen tremendous benefits in terms of partnership opportunities and the expansion of patient choice. Susan Ponder-Stansel, CEO of Alivia Care, a major hospice provider based out of Jacksonville, Florida, stated that this policy is expanding the choice for patients when it comes to hospice. In seeking care, patients shouldn’t be asked to make a difficult choice in choosing a program that may forfeit hospice coverage. This “carve-in” helps alleviate that issue.

Reimbursement Rate Increase

CMS also implemented a 2.6% increase in reimbursement in 2021, with a corresponding increase in payment cap, across all four levels of hospice care. The 2.6% increase was based on an estimated 3.0% inpatient hospital market basket reduced by the multifactor productive adjustment of 0.4%. All compliant providers (with quality reporting) will earn this higher rate across routine home care, continuous home care, inpatient respite care, and general inpatient care.

The aggregate reimbursement cap per patient is correspondingly set to increase from $29,964.78 per patient in 2020 to $30,743.86 in 2021, keeping pace with the overall rate increase. The increase in reimbursement rates increased top-line growth and created margin expansion for all hospice providers that maintain quality reporting metrics. These reimbursement rate increases are a long-term boon for hospice providers. Westcove firmly believes that this regulatory change drove an increase in interest by both private equity sponsors and strategic acquirers, further fueling consolidation within the industry.

Conclusion