Hospice Industry Insights

Introduction

The hospice industry remains one of the most fragmented and sought-after industries for investment by both private equity sponsors and strategic acquirers looking to consolidate or diversify their operations. Historically, interest in the hospice industry was fueled by extreme market fragmentation, low capital expenditures, and the increasing demand for in-home services. These trends will continue to persist well into 2021 and beyond, however there are several other drivers that are currently creating opportunities for consolidation within the hospice industry at substantial transaction multiples.

Regulatory trends such as the Medicare Advantage “carve-in” and the reimbursement rate increase (slated to come into effect in 2021), along with continued demographic shifts like the rise of hospice utilization through individual choice and changing physician referral dynamics have created an increase in demand for hospice acquisitions, despite the general economic slowdown related to COVID-19. These trends, coupled with a record amount of capital “overhang” (cash available to invest in and acquire businesses by private equity sponsors), have driven significant multiple expansion for high-quality hospice businesses.

In the following piece, Westcove will highlight each of these trends and detail why the first half of 2021 may offer a compelling time for hospice shareholders and executives to consider a capital raise, acquisition, or private equity investment.

Consolidation within the Industry

Prior to discussing the trends driving consolidation at record-breaking valuation multiples, it’s important to note the significant transactions that have occurred within this past year alone. Despite the economic impact of COVID-19, hospice transactions have continued at a flurry that will likely last well into 2021 and 2022, as recent merger & acquisition activity has drastically reshaped the industry landscape. Acquirers have prioritized well-managed and productive organizations with leading locations in their local communities. Many of the transactions consummated in 2020 have been sponsor-backed recapitalizations in the lower-to-middle-market, such as H.I.G. Capital’s investment in St. Croix Hospice for $580 million. St. Croix was previously a portfolio company of The Vistria Group and it is estimated that the company traded at a multiple of approximately 16 times EBITDA. Subsequently, Addus Homecare acquired Queen City Hospice for $192 million at 24 times EBITDA. Both these transactions serve as significant indicators that hospice companies are presently more attractive to private equity firms than ever before. The merger between Seasons Hospice and AccentCare, two of the largest hospice providers nationally, has also closed.

Below are examples of other substantial hospice transactions completed in 2020 and YTD 2021:

Trends in Hospice Utilization

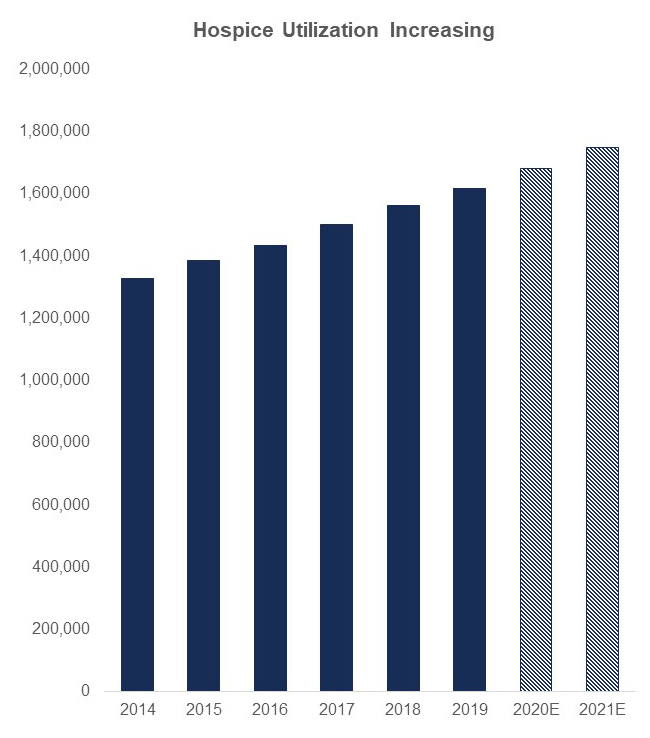

The greatest macroeconomic tailwind driving increased multiples for hospice providers is the continued rise in hospice utilization. The total average daily census for the hospice industry has increased from approximately 234,000 in 2011 to approximately 317,000 in 2019, an increase of over 35%. There are a number of factors driving this increase in utilization, but the primary drivers are the aging U.S. population and the increasing acceptance and adoption of hospice services by both referring physicians and patients.

Aging Population

The average age of the US population continues to increase at a steady rate. Today, there are 46 million adults in the US that are 65 years or older. By 2050, the number of adults over the age of 65 is projected to double to approximately 90 million. Between 2020 and 2030, the number of elderly is projected to grow by 18 million. This is due to the baby boomer generation; in 2020 to 2030 the remainder remainder of the baby boomer generation will reach the age of 65. Put more simply, by 2030 1 in 5 Americans is projected to be 65 years or older. This will lead to a direct increase in hospice utilization, especially for sunbelt states as the overall population, particularly the elderly population, prefers warmer climates.

Increased Acceptance and Adoption

Hospice providers have seen an uptick in acceptance by both patients and physicians. Patients have an increased understanding of the benefits of hospice services as a means to improve quality of life in the final stages of their lives, this has driven hospice utilization significantly. Moreover, the overall interdisciplinary team that provides care for the patient covers a variety of specialties that would not likely be available to a patient otherwise, this realization has driven adoption by the patient population. Hospice services of particular importance to patients have been palliative care, spiritual care, family access, and respite care for family and bereavement care.

As patients have increased awareness and adoption of hospice care, physicians in turn have increased referrals and adoption of hospice services for their patients. Physicians have found benefits in referring patients to hospice care like decreased re-hospitalization rates and a clear increase in end-of-life quality. There have been numerous studies that show the substantial benefits of hospice care. For example, a Journal of the American Medical Association published study completed in 2014 found that poor-prognosis cancer patients enrolled in the Medicare Hospice Benefit experienced considerably lower rates of re-hospitalizations, intensive care admissions, invasive procedures, and saw significantly lower overall health care costs during the final years of life, compared to non-hospice patients.

2021 Regulatory Changes for Hospice Providers

In addition to the longstanding drivers for consolidation, there are several regulatory developments expected to come into effect in 2021 that will spur additional growth and interest for hospice providers. The Medicare Advantage “Carve-in” and increasing reimbursement rates will drive higher valuations for hospice companies relative to historical prices and other healthcare subindustries, such as home health care.

Medicare Advantage “Carve-in”

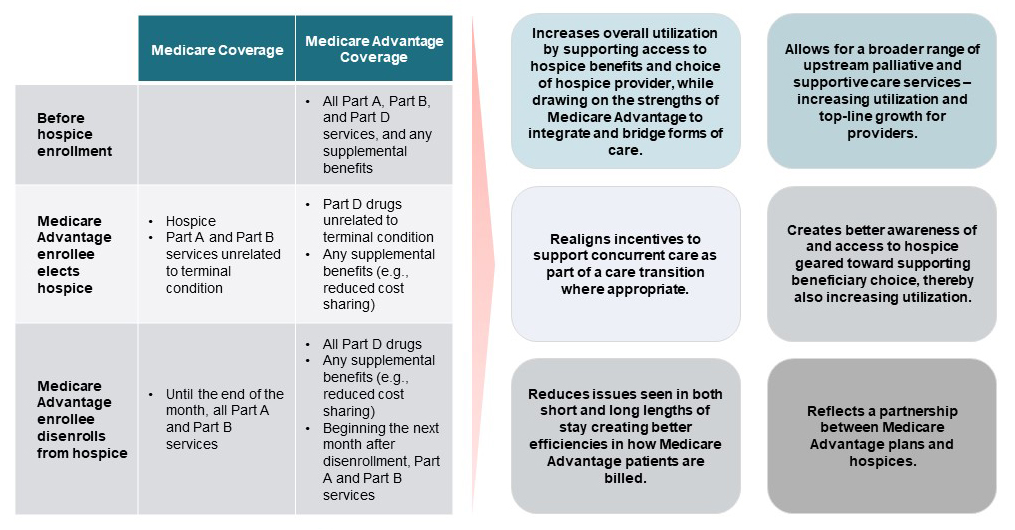

In 2021, Centers for Medicare and Medicaid Services (“CMS”) will expand coverage of hospice services for patients enrolled in Medicare Advantage plans as part of a “carve-in” provision. All four current levels of hospice care will be covered. CMS hopes that this provision will help eliminate inefficiencies and lapses in coverage and care caused by the current system, where Medicare Advantage participants have lapses in coverage and services. See the below diagram that references the flaws of the current system and the benefits of the new system:

The hospice “carve-in” to Medicare Advantage is slated to roll out over a four-year period beginning in January 2021. If the roll-out is successful, it will effectively align the interests of all immediate stakeholders, patients, hospice providers, and Medicare Advantage providers. This new regulation will lead to benefits for all parties involved. Patients will benefit from the greater awareness, access to, and understanding of all options available to them. Hospice providers will be able to provide a platform to support more patient needs through enhanced collaboration with plans and other providers. They will also be given a greater opportunity to showcase hospice and upstream palliative services. Finally, Medicare Advantage providers will benefit from serving as a point of accountability and hub for ensuring robust access to a seamless continuum of care for patients.

Medicare Advantage “Carve-in” Continued

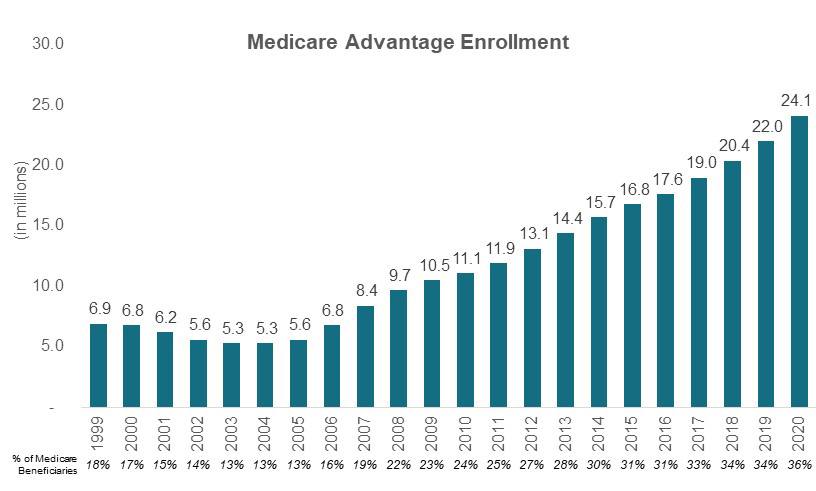

Westcove believes primary care and hospital referrals are likely to significantly increase due to the “carve-in” supporting even greater hospice utilization in 2021 and beyond. Medicare Advantage enrollment has grown rapidly over the last two decades, both in overall volume and as a percentage of total Medicare Enrollment, as demonstrated in the chart above. Catering to this largely untapped population will provide substantial tailwinds for hospice providers. This in turn will create more demand and interest in hospice providers, further pushing valuations higher.

Reimbursement Rate Increase

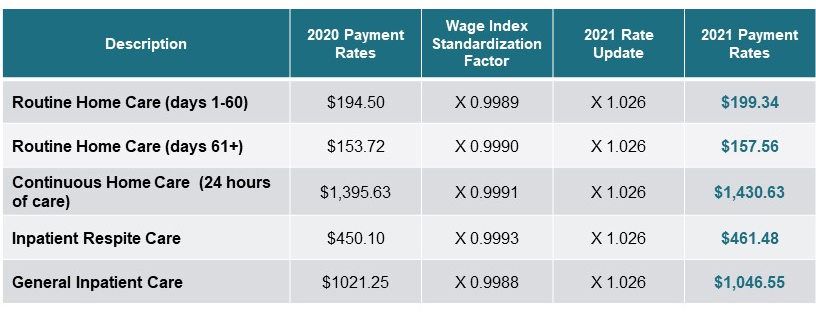

CMS is also slated to implement a 2.6% increase in reimbursement in 2021, with a corresponding increase in payment cap, across all four levels of hospice care. The proposed 2.6% increase is based on an estimated 3.0% inpatient hospital market basket reduced by the multifactor productive adjustment of 0.4%. All compliant providers (with quality reporting) will earn this higher rate across routine home care, continuous home care, inpatient respite care, and general inpatient care, as shown in the below table:

Reimbursement Rate Increase Continued

The aggregate reimbursement cap per patient is correspondingly set to increase from $29,964.78 per patient in 2020 to $30,743.86 in 2021, keeping pace with the overall rate increase. An increase in reimbursement rates will undoubtedly increase top-line growth and create margin expansion for all hospice providers that maintain quality reporting metrics. Westcove firmly believes that this regulatory change will drive a substantial increase in interest by both private equity sponsors and strategic acquirers, further fueling consolidation within the industry.

Conclusion

The longstanding drivers of market fragmentation and increasing hospice utilization, coupled with new positive regulatory developments will likely push an already active mergers and acquisitions market for hospice providers to all-time highs. COVID-19 has done little to cool down the market, with significant hospice deals being completed as recently as October 2020, with H.I.G Capital announcing their substantial investment in St. Croix Hospice, previously a portfolio company of The Vistria Group. With Private Equity dry powder levels reaching approximately $1 trillion dollars of uninvested capital and a potential change in fiscal policy on the horizon, the current market environment remains an ideal time for hospice providers to consider a transaction or recapitalization. A transaction or recapitalization would allow hospice providers to maximize their equity value at a time when the market is increasingly becoming more attractive for investors and strategic acquirers, leading to premium valuations during competitive transaction processes.