Oral Surgery Industry Insights

Market Trends and M&A Activity

February 2021

Introduction

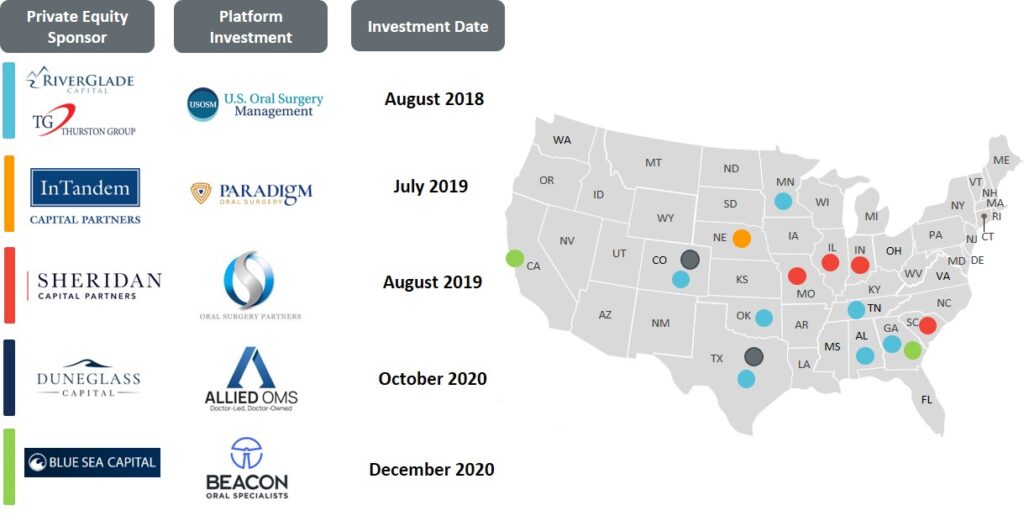

Consolidation in the oral surgery sector is following a similar pattern to other physician specialties (dermatology, ophthalmology, gastroenterology, etc.), wherein a first-mover investor establishes a platform organization in a key geography and seeks to establish regional dominance through add-on acquisitions of smaller practices. Following the success of the initial platform, additional investors then establish competing platforms in new geographies until a saturation point is reached. Presently, there are five private equity-backed platforms. Westcove believes this may figure may grow to eight to ten over the next one to three years before existing platforms pursue secondary recapitalizations (“second bite of the apple”). In addition to new private equity sponsors seeking platform investments, existing platforms will continue to expand via add-on acquisitions of smaller practices in local and regional markets to broaden and solidify their market presence across the United States.

In the following piece, Westcove will highlight the key trends driving consolidation in oral surgery, summarize recent consolidation activity, and detail why the first half of 2021 may offer a compelling time for founders and executives of oral surgery practices to consider a capital raise, acquisition, or private equity investment.

Consolidation within the Industry

The above chart illustrates the value created through multiple arbitrage:

– A platform oral surgery practice with $5 million of Adjusted EBITDA is valued at a 10.0x multiple in a private equity transaction, resulting in a $50 million valuation.

– Leveraging the expertise of its private equity partner, the platform acquires another practice with $2 million of Adjusted EBITDA at a 7.0x multiple through an add-on acquisition. This transaction is valued at $14 million.

– Through payor synergies and operational efficiencies with the platform, the acquired practice is able to generate an additional $500 thousand of Adjusted EBITDA per year that accrues to the platform at the original 10.0x valuation. This creates an additional value of $5 million.

– As a result of the multiple arbitrage of 3.0x (10x – 7.0x) between the platform and the add-on acquisition on the original $2 million of Adjusted EBITDA, there is an additional $6 million of value that is created through the partnership for the platform entity.

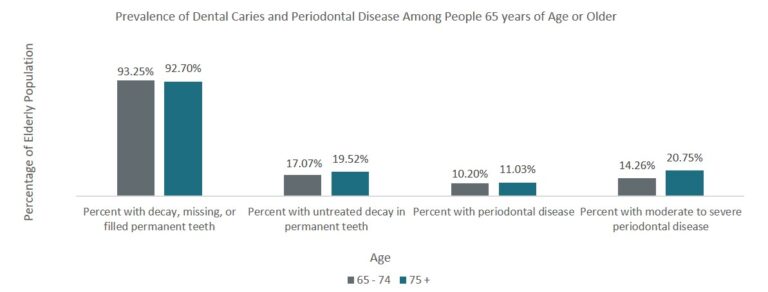

Westcove believes that demand for oral surgery procedures will increase in the foreseeable future. This increased demand is driven by numerous factors, namely an aging US population, the prevalence of oral cancer, dental caries and periodontal disease within the geriatric population, and growing disposable income which is predicted to translate to an increased willingness to spend out-of-pocket for medically-necessary oral surgery procedures, and cosmetic dental procedures.

Oral surgery has become an immensely attractive sector to private equity investors over the last three years and Westcove expects it to remain so for the foreseeable future. The oral surgery industry is enticing to private equity investors for numerous reasons, four of which are highlighted below.

Fragmentation

The oral surgery industry is highly fragmented as there are over 9,000 oral surgeons in the US, with the vast majority practicing in 1-2 surgeon practices. Like other physician specialty practices, oral surgeons and their practices tend to be localized, serving a relatively small patient and referral base. In more populous regions, numerous smaller (1-2 surgeon) and mid-size (3-4 surgeon) practices compete locally and regionally for patients and referral sources. In less populated regions, relatively few small practices (1-2 surgeons) compete on a hyper-localized basis for patients and referral sources. Thus, such extreme fragmentation is enticing to investors. By leveraging a “roll-up” strategy that bundles several practices together to create a cohesive organization that offers clinical excellence, the combined organization gains the scale to achieve operational efficiencies and the leverage to negotiate more favorable payor contracts.

High-Margin Procedures

Oral surgery procedures can range from tooth extractions to reconstructive jaw surgery. The spectrum of fees associated with the range of services provided by oral surgeons is expansive; tooth extractions can range in the hundreds of dollars, while extensive oral and jaw surgeries can cost in the tens of thousands of dollars. The blending of lower margin procedures with multiple high margin procedures produces a relatively high margin compared to other healthcare sectors, making it enticing to investors.

Highly Productive Practitioners

It is no surprise that since the cost of oral surgery procedures is relatively high, an individual oral surgeon or smaller group of oral surgeons (1-3 practitioners) can generate meaningful Adjusted EBITDA (earnings before interest, tax, depreciation and amortization, plus adjustments for personal, one-time, or other expenses paid for by the business). It is noteworthy that from 2011 to 2016, the average number of monthly oral and maxillofacial surgeries by practices increased from 24.92 to 29.25. While more recent data is not available, it is likely that this figure has increased or at least remained flat, coinciding with demographic and macroeconomic changes.

Essential Procedures

Presently, the COVID-19 pandemic has challenged every aspect of society, and few industries, including healthcare, were immune from the negative economic effects of job layoffs, reduced consumer spending, and government shutdowns. Those services deemed “essential” by local and national governments avoided the worst of the pandemic and have provided investors with a new lens through which to gauge investment opportunities. Oral surgery, unlike general dentistry, was considered essential in many regions and was thus allowed to continue operating at a time when a myriad of other medical treatments, and elective surgeries were prohibited. Thus, private equity investors, as well as established dental organizations, are continuing to add oral surgery practices to their respective portfolios to expand their revenue mix and mitigate against potential future closures due to public health and economic crises.

National Oral Surgery Platform Transactions