Cardiology Industry Insights

Market Trends and M&A Activity

Updated May 2022

Introduction

As of this publishing, private equity investment into the cardiology specialty has been limited. Historically, merger & acquisition activity in the cardiology industry has been largely driven by hospitals and health systems looking to expand their operations and revenue base through the employment of cardiologists through an integrated model. As hospitals and health systems have continued to acquire cardiology practices, physicians have continued to be driven to enter hospital employment arrangements, and as a result, have lost a great deal of operational autonomy. Westcove believes that the cardiology industry will begin to experience a shift away from health system-led consolidation to private equity driven merger & acquisition activity that will dramatically increase transaction volume in the near-term as leading practices consolidate to gain scale and preserve independent practice.

Investment from private equity will create new avenues for cardiology practices to grow in terms of both size and scale, outside of the traditional partnership route of partnering with a health system. By leveraging the capital and expertise of a private equity partner, cardiology practices can grow through a variety of ways including acquisitions or partnerships with other like-minded practices and the development of de-novo locations, while having the capital necessary to invest in the analytics capabilities and infrastructure necessary to profitably transition towards value-based payment models. By gaining size and scale, independent practices will have an opportunity to gain negotiating leverage with payors and local health systems that previously did not exist. For leading practices, a private equity partner can offer an opportunity to expand their scope of clinical operations, share best practices, and take better care of a greater number of patients.

In the following piece, Westcove will discuss these trends and detail why 2021 will likely be a dynamic year for the cardiology industry as private equity capital begins to enter the specialty.

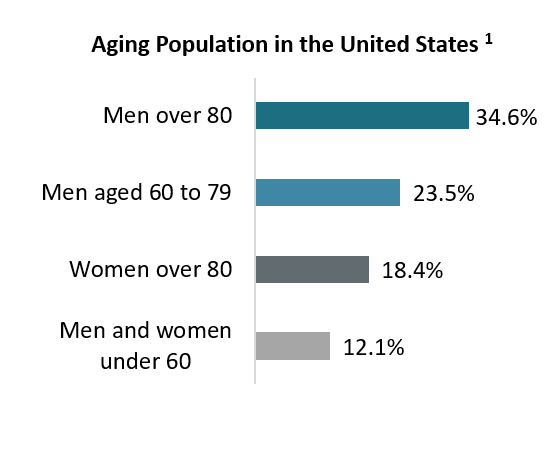

Aging Population

The adult obesity rate measures individuals that can be classified as obese based on Body Mass Index (BMI), where a BMI over 20% meets the criteria for medically obese. Clinical studies have illustrated the connection between heart disease and obesity, increasing risks of circulation issues, hypertension and diabetes, and coronary conditions. The adult obesity rate is expected to increase in the future, with almost half of the U.S. population projected to have obesity by 2030.

Dynamic Market Enviorment

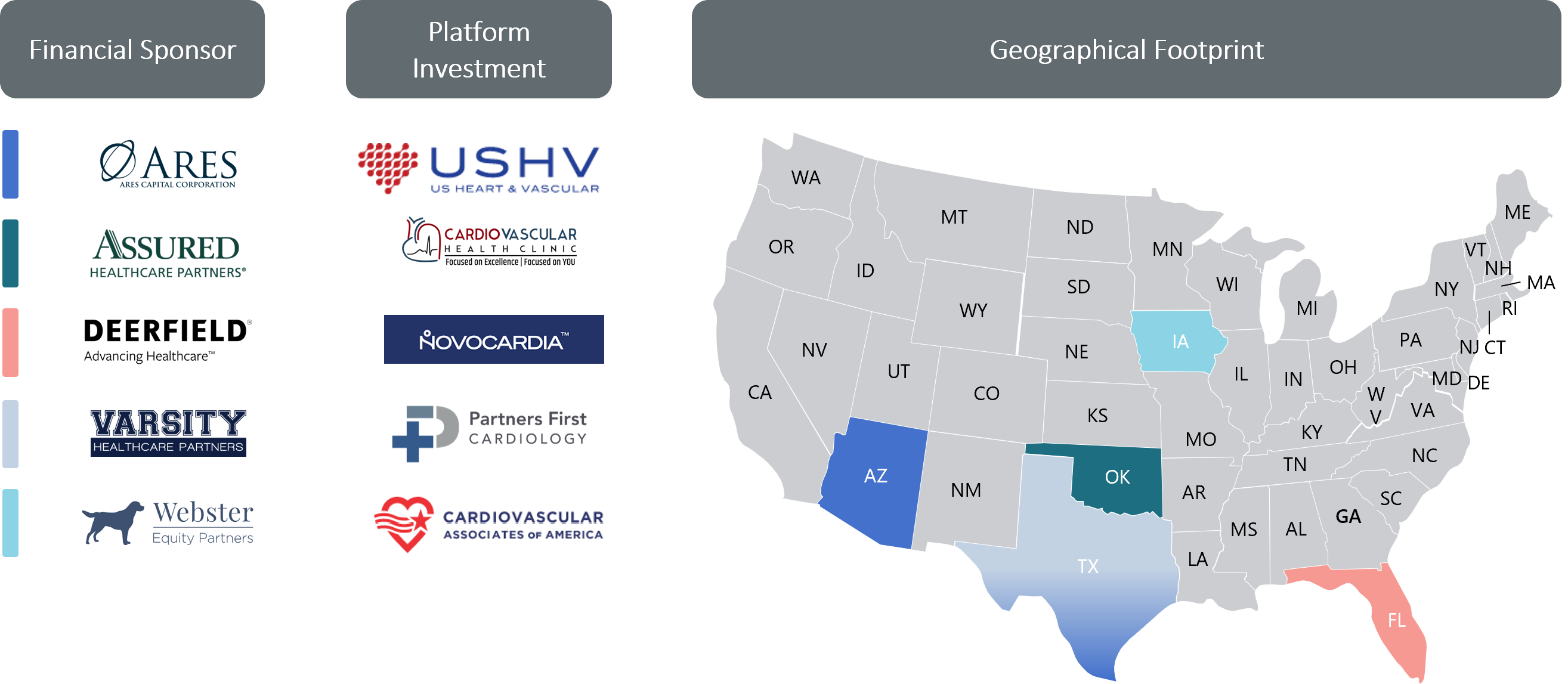

As previously mentioned, private equity investment within the cardiology sector will follow a similar pattern to other physician specialties such as: gastroenterology, orthopedics, women’s health, urology, and pain management. The first private equity transaction within cardiology was announced in November of 2020 when Partners First Cardiology, an Austin, Texas-based cardiology and cardiovascular physician practice management organization, announced its partnership with Varsity Healthcare Partners. Varsity Healthcare has also made investments into gastroenterology, orthopedics, eyecare, and dermatology. Through their partnership with Varsity Healthcare, Partners First is attempting to create a national platform of leading cardiology practices, while also offering an opportunity for health system integrated cardiologists to return to community-based practice.

Following the Partners First transaction, Westcove expects there to be a wave of private equity investment over the next 12 to 24 months as other leading cardiovascular organizations form platforms in partnership with private equity firms.

Previously, within the cardiology specialty, compliance with the fair market value provisions of Stark Law, has restricted the transaction values and multiples of M&A activity as sellers have been unable to benefit from competitive transaction dynamics that often push valuations well above fair market value. Investment from Private Equity sponsors will potentially raise transaction values as they do not have to adhere to the same fair market value restrictions that health systems do. In addition, private equity transactions offer an alternative to the traditional hospital employment model where physicians continue to own equity and drive the growth and decisions of the organization.

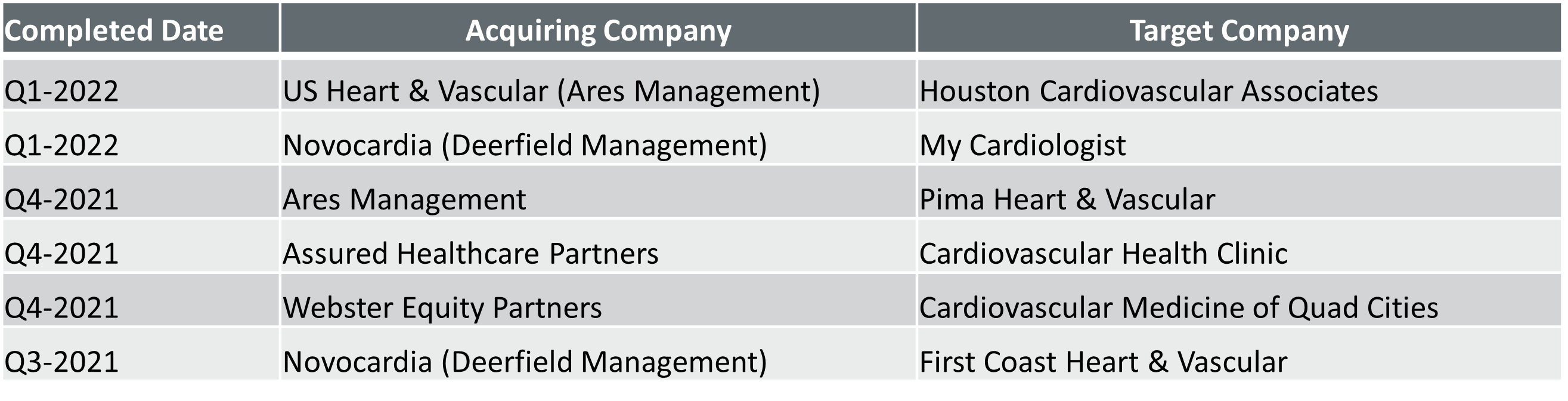

A sample of recent transaction in the cardiology specialty is listed below between late 2019 and 2021.

Considering a transaction is an immensely personal decision. Shareholders must consider multiple economic and interpersonal factors when thinking through when and how best to pursue a transaction. A group might be interested in partnering with a financial sponsor to pursue growth, considering retirement in the relative near future, or want to mitigate the personal financial risk of having the vast majority of their wealth is concentrated in their practice. Again, each shareholder’s decision is incredibly personal and is usually a combination of several factors.

The advent of private equity investment into cardiology represents an opportunity for shareholders to seek access to growth capital and pursue personal financial risk mitigation for the first time. Unlike bank lending, private capital can be tailored to meet the needs of the business, helps align incentives among partners, and provide financial diversification previously unavailable to the shareholders of cardiology practices.

In a typical deal structure, private equity sponsors will typically make a control investment (greater than 50%) in a practice, and invite the shareholders to maintain a meaningful equity percentage (e.g. 20% – 30%, “rollover equity ”) in the newly created platform entity. Additionally, shareholders no longer personally guarantee the financing of the Company. Other factors such as productivity, day-to-day management, and facilitating growth of the newly formed entity become the chief concerns of the physician shareholders and management team, while the decisions are made by the clinical leaders of the organization. As this entity grows organically and through add-on acquisitions; profitability increases through the realization of operational and administrative efficiencies. Physician shareholders participate in the growth through continued ownership in the platform entity, while not having to personally guarantee capital for growth. Shareholders often participate in the substantial appreciation of equity value in the platform entity upon a secondary recapitalization, or “second bite of the apple,” after what is typically a five-to-seven-year period. In sum, shareholders can monetize the hard-earned value they have achieved over their careers, while reducing personal financial risk through asset (practice) diversification and pursuing broader growth strategies while meaningfully participating in the upside of such growth.

Sources:

CapIQ; MergerMarket; U.S. Census Bureau; Harvard T.H. Chan School of Public Health; IBISWorld, “Heart Growth: Demand From Seniors and Increased Healthcare Coverage Will Support Industry Growth”; 2 Specialty Networks Consulting, “Cardiology Market Research and Cardiology Groups in USA”