Justin Hand

Managing Director

Lending Environment Impact on Healthcare Services M&A

Market Trends and M&A Activity

August 2023

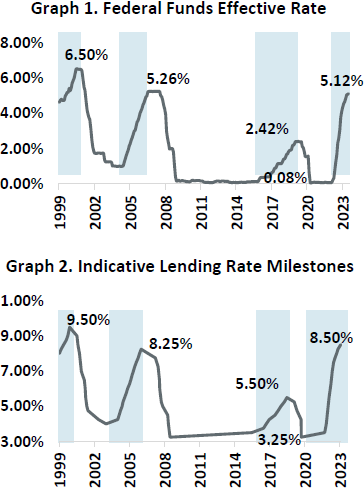

Recent U.S. Federal Reserve (“Fed”) policy has marked some of the swiftest and most aggressive interest rate increases in recent history. Since March 2022, the U.S. Federal Reserve has raised interest rates 11 times to combat inflation after the COVID-19 pandemic. The federal funds effective rate rose from approximately zero percent to over five percent in the span of 17 months. These rates mark the highest level seen since the Great Recession in 2007 and 2008.

The federal funds effective rate has a direct correlation to a wide variety of financial metrics, including lending rates. As the federal funds effective rate increased dramatically in the past 17 months, so did lending rates. Due to this dramatic increase, investment decisions, such as those made by private equity firms deliberating healthcare service investments, were made more cautiously than they were during the previous low-rate environment between 2020 – 2022.

Nevertheless, healthcare services M&A has remained relatively resilient. In addition to the relatively non-cyclical nature of the sector, another contributing factor to the sector’s resiliency is private equity’s significant dry powder or deployable capital. As the lending rate settles to this higher paradigm, we are seeing private equity investors refocus on high-quality partnerships.

Over the last twelve months, despite the shift in the lending environment, Westcove has successfully facilitated eight partnerships at valuations above the expectations of founders and owners. With more than 40 years of experience in healthcare M&A, the team is able to create competitive processes to drive valuation and efficient closings. The Company is thrilled to have supported deals that have yielded over $1 billion in aggregate transaction value for its clients in the last 30 months.

Rate Hikes Spur M&A to Refocus on Partnership Strategies

The Fed kept interest rates at near zero from 2020 to 2021 to limit economic damages and negative investor sentiment from the COVID-19 pandemic. In early 2022, inflation concerns grew as wage growth accelerated and consumers spent more and saved less. The Fed enacted a tighter monetary policy to combat inflationary measures and implemented a series of rate hikes from March 2022 to July 2023.

The federal funds effective rate reached 5.10% in early July 2023 (Graph 1). At the end of July 2023, the Fed further increased the federal funds rate to a new target range of 5.25% – 5.50%, the highest level in 15 years.

As the federal funds effective rate reflects the cost of capital for banks, banks started to quote higher lending rates to individuals and investors. The lending rate level is approximately 8.50% as of July 2023, which is more than double from the 3.25% – 3.50% level between March 2020 and March 2022 (Graph 2).

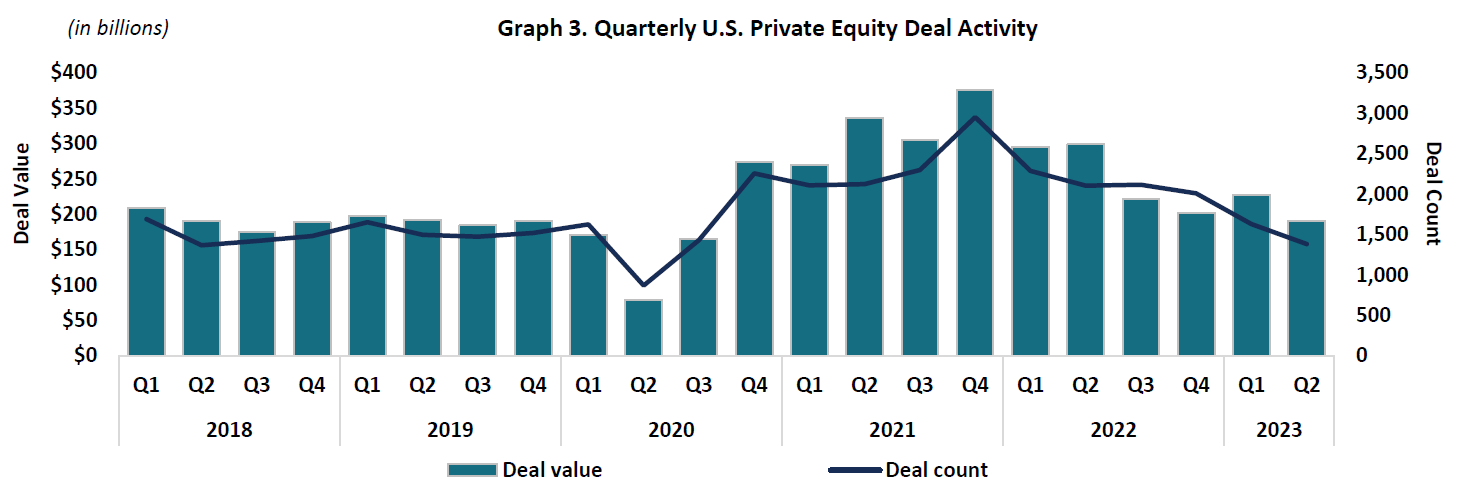

Following a higher interest rate environment, M&A activity across all sectors has generally slowed and valuation multiples have decreased.

In a high-rate environment, investing in the right opportunities becomes even more critical since speculative investments can be costly with higher leverage. U.S. private equity deals plummeted by 21.5% to $295 billion in Q1 2022 from the peak of $376 billion in Q4 2021. The U.S. private equity deal activity has returned to the pre-pandemic level of 1,383 deals in Q2 2023 of $191 billion (Graph 3).

However, the downtrend in M&A is softening. As the current paradigm on interest rates prevails, more investors and private equity firms withholding capital deployment will adjust accordingly and engage in M&A activities.

Resilient Healthcare Services M&A

After experiencing record-breaking years for healthcare services deals in 2021 and 2022, deal volumes in the 12 months ending in May 2023, showed a modest 4.4% decline compared to the previous year. Despite the decline, the current volumes remain nearly double those seen from 2018 to 2020, indicating a sustained level of activity in the market. Deal values also saw a more significant decrease of 15.0%, continuing the trend observed in 2022, where a larger proportion of deals were driven by smaller value roll-up and add-on transactions in the lower to mid-market, rather than transformative platform and mega deals.

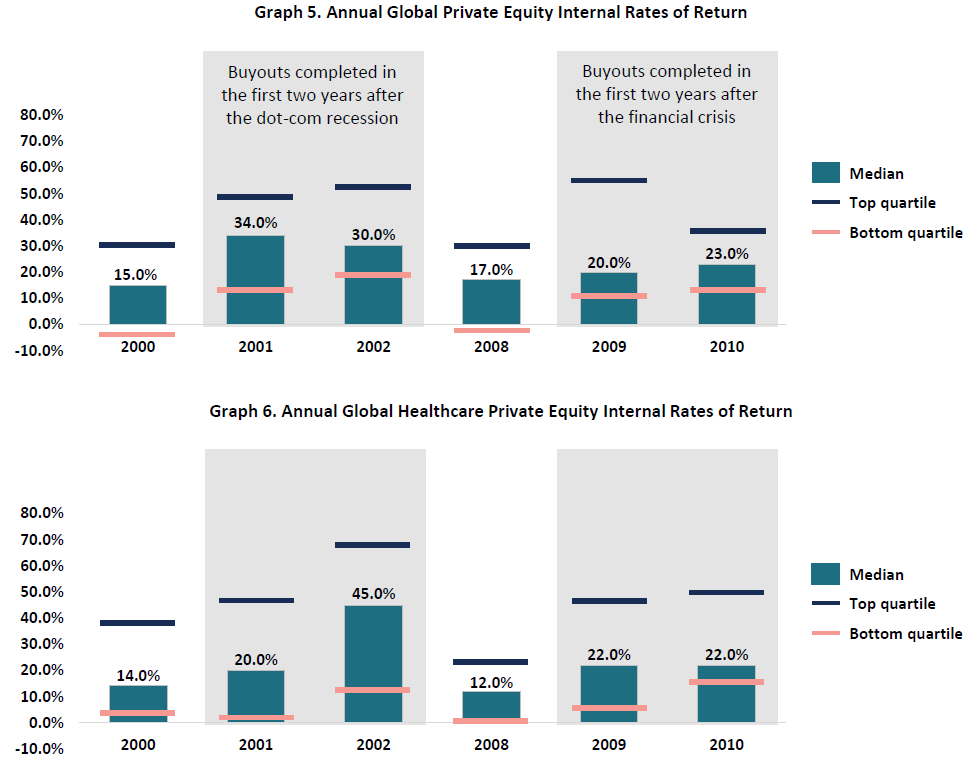

Non-cyclical Nature of the Healthcare Industry

Healthcare private equity has showcased remarkable resilience compared to overall private equity activities across sectors during past recessions, delivering consistent and rapid recoveries with compelling returns. As an illustration, following the downturn caused by the dot-com bubble in 2000 – 2001, healthcare deals closed in the subsequent two years achieved an impressive average return of over 30.0%. Similarly, after the global financial crisis in 2008 – 2009, healthcare rebounded quickly and performed better than it was before the crisis. While this trend is seen across all private equity, healthcare private equity stands out with exceptionally attractive returns. Notably, the top quartile of healthcare private equity transactions yielded internal rates of return of approximately 40.0% or even higher in the first two years post-recession.

Specifically, the healthcare services sector within the overarching healthcare industry is enticing to private equity firms due to its stable cashflows and inelastic demand. In the prevailing high-interest rate environment, stable cashflows are especially valued, as they facilitate debt servicing for typical private equity partnerships that often involve substantial leverage. According to VMG Health’s 2023 Annual Healthcare M&A Report, healthcare services M&A value posted a year-over-year increase of approximately 5.0%.

Private Equity’s Significant Dry Powder Reserves

Despite M&A activities slowing in 2022, a substantial level of “dry powder” is in place to support the momentum for the near term. “Dry powder” is capital committed for investments but has yet to be deployed. Global private equity dry powder has rapidly increased for over a decade, reaching an all-time high of $3.7 trillion in 2022, a staggering growth compared to five years ago (Graph 7). As of May 2023, U.S. private equity firms have consistently expanded their dry powder, surging from $0.7 trillion in 2018 to a significant $1.1 trillion (Graph 8). This influx of available capital presents a promising outlook for the healthcare services sector, as investors actively seek recession-resilient opportunities such as healthcare services for their investments.

Drivers From Healthcare Services Sectoral Trends

In addition to private equity’s dry powder, the trends within the healthcare services sector also drive consolidation and M&A activity. For example, the physician practice management subsector is experiencing a material shift towards value-based care to prioritize efficiency and patient care. Concurrently, the shift towards outpatient services has led to substantial investments in ambulatory surgery centers. Several subsectors have increasing ambulatory surgery centers certified by Medicare, including orthopedics, plastics, and cardiology. Other trends include the widespread adoption of telehealth and electronic medical/health records in the primary, specialty, and urgent care services subsector.

Given these sectoral trends, many healthcare services organizations contemplate partnerships with private equity firms to optimize efficiency in their operations by reducing costs and fueling growth. The inflation that prompted the Fed to raise interest rates has made cost savings more challenging without scaling. According to the U.S. Bureau of Labor Statistics, employee payrolls in the ambulatory healthcare services subsector increased to $8.4 million in May 2023, a 2.9% growth from July 2022. Besides payroll increases, the transition to value-based care has also made capitation payment models popular, adding importance for practices to operate more efficiently.

In order to maintain competitiveness in the sector, scaling and securing growth capital in a high borrowing cost environment are critical matters to healthcare services. Partnering with larger platforms backed by private equity firms is a common avenue to propel. Hence, the momentum of healthcare services M&A activity is expected to be sustainable.

Navigating Healthcare Services M&A

In a lending environment characterized by higher interest rates for an extended period, Westcove continues to offer unwavering support to founders and operators on their entrepreneurial journeys. While M&A activity may have slowed down in most other sectors, the lower to mid-market healthcare services sector Westcove specializes in has demonstrated remarkable resilience. Westcove’s success is a testament to this trend. In 2021, we facilitated the formation of six partnerships, followed by seven in 2022. Thus far, in 2023 we have successfully closed four transactions.

With a wealth of experience in M&A advisory services, totaling over $1 billion in transaction value, Westcove has honed its ability to create a competitive process and ensure that founders and operators receive the value they rightfully deserve for their years of dedication, regardless of the lending climate. Westcove plays a vital role in preparing founders and operators for success, offering strategic counsel, connecting them with an extensive and selective network of financial and strategic partners, and diligently managing the marketing process to achieve optimal outcomes.

In conclusion, the healthcare services sector remains robust and promising, with its resilience shining through amidst macroeconomic challenges. With our commitment to delivering the best value to businesses considering partnerships, we are confident in our ability to prove our worth as trusted partners in achieving successful outcomes.

Sources:

Bain, Bank of America, DealEdge, Financial Times, Federal Reserve Bank of St. Louis, N.A. Prime Rate, Pitchbook, Preqin, PwC, U.S. Bureau of Labor Statistics, VMG Health, Workweek