Introduction and Industry Recap

Westcove believes oral surgery is enticing to investors because of its high margin services, high industry fragmentation, robust administrative competency of typical oral surgery practices, and entrepreneurial spirit of its founders/partners. As referenced in the original white paper, consolidation in oral surgery is following a similar pattern to other physician specialties (dermatology, ophthalmology, gastroenterology, etc.), wherein a first-mover investor establishes a platform organization in a key geography and seeks to establish regional dominance through add-on acquisitions of smaller practices. Following the success of an initial platform, additional investors then establish competing platforms in new geographies until a saturation point is reached.

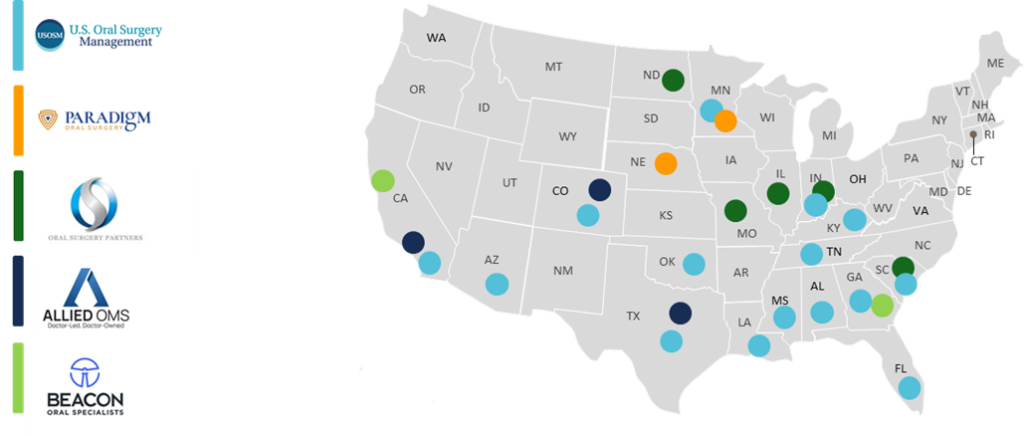

Presently, there are five private equity-backed platforms. Westcove believes this figure may grow to eight to ten over the next one to three years before existing platforms pursue secondary recapitalizations (“second bites of the apple”). In addition to new private equity sponsors seeking platform investments, Westcove expects existing platforms will continue to expand via add-on acquisitions of smaller practices in local and regional markets to broaden and solidify their market presence across the United States.

Westcove encourages reading of its prior white paper, as in the following piece, Westcove will summarize recent consolidation activity, highlight new investment trends, and outline why the second half of 2021 may offer a compelling time for founders and executives of oral surgery practices to consider a capital raise, acquisition, or private equity investment.

Recent Oral Surgery Consolidation

National Oral Surgery Platforms Continue to Expand

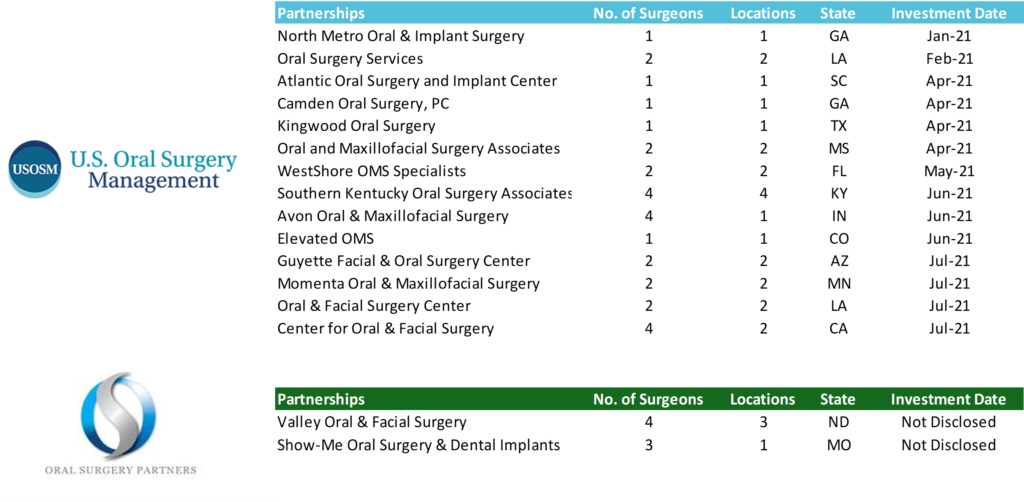

Since early 2021, private equity-backed management organizations have continued to expand across the country. USOSM, initially concentrated in the Southeastern US, has expanded into both the Western US and the Midwest. Oral Surgery Partners has expanded from Missouri into neighboring Midwestern states, and recently entered the South Carolina market. Additionally, recent investments made demonstrate a subtle shift in strategy that speaks to both the scale of the organizations, appetite to enter new markets, and willingness to partner with smaller practices.

Investment Trends to Watch

There are multiple interesting investment trends that have characterized the recent investment activity by private equity-backed management organizations: entry into new markets through partnerships with small one- or two-surgeon practices, and heightened interest in mid-size practices (three to five surgeons) due to both the relatively limited administrative complexity associated with mid-size practices and the availability of mid-size practices in the marketplace (when compared to large practices).

Entrance into New Markets Through Single or Dual Surgeon Practice Partnerships

Expansion into new states and markets was historically completed through partnerships with “regional platform” practices; larger five-plus-surgeon, multi-site practices that allowed a private equity-backed management service organization to establish themselves in a local market. While these “regional platforms” would be part of the larger “national platform”, these regional partnerships provided credibility, a strong revenue base, and referral network within a new state or regional market. USOSM and others have since expanded into new states and regions through partnerships with single- and dual-surgeon practices. This signals a paradigm shift in investment criteria that speaks to the scale of these organizations, and their ability to effectively onboard new practices in new geographies.

Companies like USOSM used to be heavily reliant on the strength of a “regional platform’s” reputation, infrastructure, and referral networks to operate effectively in a new geography. Now, USOSM has grown in both size and capability and can leverage their national brand and platform such that they can confidently enter new markets through partnerships with smaller practices. As further detailed below, this has resulted in changing local market dynamics.

Heightened Interest in Mid-Size Practices

When the first investments by private equity sponsors were made between mid-2018 and mid-2019, sponsors sought to partner with large (ten-plus-surgeon and multi-site) practices or partner with multiple local or regional practices to establish an initial platform. Early investments in large practices allowed financial sponsors to deploy meaningful amounts of capital from their funds through a lower volume of large transactions and set the stage for smaller, accretive add-on acquisitions. One can see a similar dynamic at play through Blue Sea Capital’s creation of Beacon Oral Specialists through the combination of Atlanta Oral & Facial Surgery (Georgia), and Bay Area Oral Surgery Management (Northern California), two of the largest practices in the country.

While there is undeniably still interest to partner with larger practices (especially for new private equity entrants), most of the existing sponsors and even new entrants have heightened interest in mid-size (three- to five-surgeon) practices. This is due to several factors: first, there are not many large (ten-plus-surgeon) practices in the national market, second, mid-size practices (three to five surgeons) can become a regional or national platform and provide the administrative infrastructure to grow both organically and through acquisition, and third, mid-size practices tend to have less administrative complexity and less difficult shareholder dynamics than larger practices. Sponsors can more quickly and efficiently partner with mid-size practices than they can with larger practices, increasing sponsor interest in mid-size practices.

Changing Local Market Dynamics

Both trends mentioned above have changed local market dynamics for practice founders and partners looking to expand through acquisition. While interest rates remain low, practice founders and partners hoping to acquire other practices may be required to compete for acquisitions more fiercely against sophisticated private equity-backed business development teams with significant financial resources.

Considering a Transaction

Considering a transaction is an immensely personal decision. Shareholders must consider multiple economic and personal factors when thinking through when and how best to pursue a transaction. A shareholder might be interested in partnering with a financial sponsor to pursue growth, considering retirement in the relative near future, or want to mitigate the personal financial risk of having the vast majority of their wealth concentrated in their practice. Again, each shareholder’s decision is incredibly personal and is usually a combination of several factors.

The advent of private equity investment into oral surgery represents an opportunity for shareholder(s) to seek access to growth capital and pursue personal financial risk mitigation for the first time. Unlike bank lending, private capital can be better tailored to meet the needs of the business, align incentives among new financial partners, and provide financial diversification previously unavailable to the shareholders of oral surgery practices.

Transaction Structuring and Tax Considerations

In a typical deal structure, private equity sponsors will make a control investment (greater than 50%) in a practice and invite the shareholders to maintain a meaningful equity percentage (e.g., 20% – 30%, “rollover equity”) in the newly created platform entity. The new entity’s debt facilities are guaranteed by the platform and the shareholders no longer have personal financial liability for the practice. Other factors such as productivity, day-to-day management, and facilitating growth of the newly formed entity become the chief concerns of the shareholders and management team. As this entity grows, both organically, through add-on acquisitions, and increasing profitability through the realization of operational and administrative efficiencies, shareholders participate in the growth through continued ownership in the platform entity.

Shareholders will often participate in the substantial appreciation of equity value in the platform entity upon a secondary recapitalization, or “second bite of the apple,” after what is typically a five-to-seven-year period. In sum, shareholders can monetize the hard-earned value they have achieved over their careers, while reducing personal financial risk through asset (practice) diversification and pursuing broader growth strategies while meaningfully participating in the upside of such growth.

Shareholders must also consider the proposed changes to the capital gains tax rate in 2022. The Biden Administration has proposed increasing the long-term capital gains tax rate to the ordinary income tax rate, an increase from 23.8% to potentially 43.4%. While it is unclear whether long-term capital gains tax rates will increase to the full ordinary income tax rate, finance industry professionals firmly believe that the long-term capital gains tax rate will increase substantially in 2022. Shareholders and practice founders must carefully consider when and if a possible transaction makes sense for them personally and their organizations.