Justin Hand

Managing Director

Fertility Services Industry Insights

Market Trends and M&A Activity

October 2023

Introduction

The fertility services market has consistently garnered strong interest from private equity investors. The recent technology advancements as well as the expansion into ancillary services, such as advanced genetics and donor services, by these independent fertility service practices are driving factors that continue to pique investor interest. Several lifestyle factors such as later childbearing age as well as increased obesity and infertility for both men and women are reshaping the fertility services landscape. These lifestyle factors will require patients and independent practices to think beyond traditional forms of healthcare. The fertility services specialty has a significant private pay component which provides a highly attractive reimbursement profile and is extremely recession-resistant as demand is often driven by the individuals. For these reasons, independent fertility services practices have a unique opportunity to meet the ever-changing demands of their patients by partnering with private equity firms.

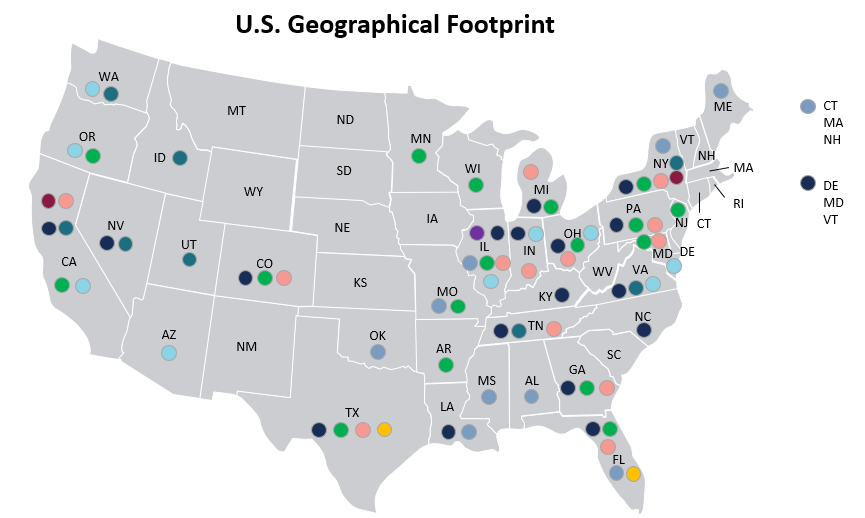

Despite private equity entering the fertility services space as early as 2015 with TA Associates’ recapitalization of CCRM, which is now an affiliate of Unified Women’s Healthcare, the market remains highly fragmented. Since then, the market has grown to nine private equity-backed platforms making investments across the United States. Private equity has enabled fertility service providers to improve operational efficiencies, data analytics, and where relevant, payor contract negotiations to reduce costs. Through the consolidation of the market, these fertility service groups can share best clinical practices and create a larger geographic footprint that will ultimately provide and serve a greater number of patients.

In the following white paper, Westcove will discuss these favorable macroeconomic tailwinds and detail why the subsequent years will be a dynamic time for independent fertility services practices as private equity continues to demonstrate significant interest and investment in the specialty.

Consolidation within Fertility Services

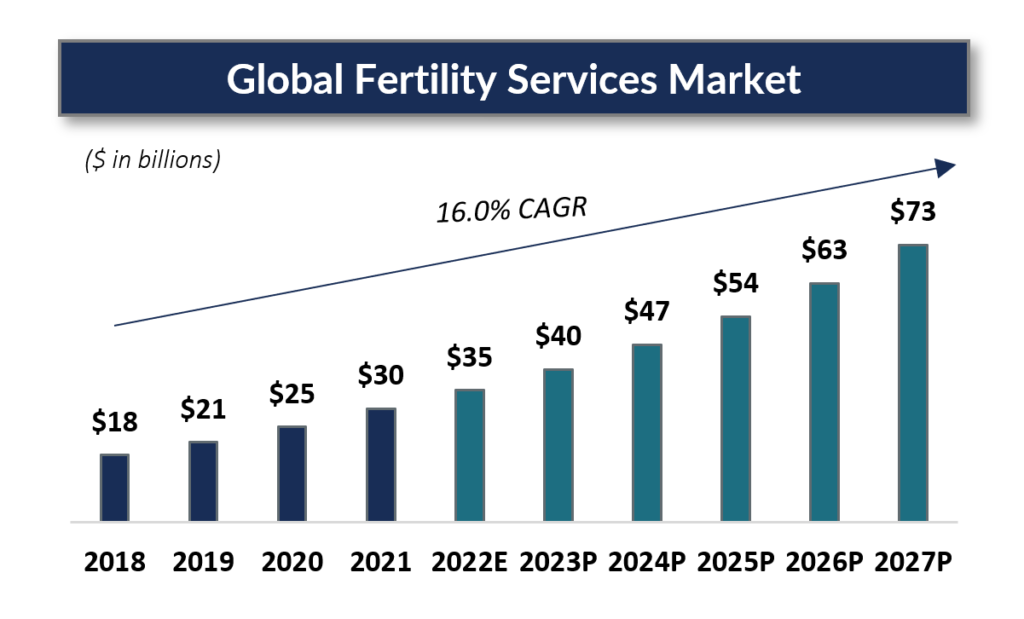

In recent years, the fertility services market has experienced a notable trend towards consolidation led by private equity’s first partnership in 2015, with TA Associates’ recapitalization of CCRM, which is now an affiliate of Unified Women’s Healthcare. The fertility services market in the United States alone has experienced an average annual growth rate of 3.8% from 2016 to 2021. Since then, there has been a steady increase in transactions with a total of nine private equity-backed platforms within the space. The continued consolidation is due to add-on acquisitions from independent fertility services practices that want to partner and join these larger, well-established networks. Recently, further consolidation has been driven by these larger, well-established networks that are seeking ancillary service lines, such as advanced genetics testing clinics, egg donation banks, and surrogacy agencies, to help bolster their ancillary service lines.  The addition of these ancillary service groups is attractive to these independent fertility practices because it allows these practices to provide highly personalized and holistic care while meeting the needs of the patients. As demand for fertility services increases across the country, the global fertility services market is projected to grow from $30 billion in 2021 to $73 billion in 2027, a CAGR of 16.0%. To meet and address this growth, these fertility services practices must consider a partnership that will provide them with the scale, resources, expanded service lines, and geographic reach to keep their competitive advantage in today’s changing market.

The addition of these ancillary service groups is attractive to these independent fertility practices because it allows these practices to provide highly personalized and holistic care while meeting the needs of the patients. As demand for fertility services increases across the country, the global fertility services market is projected to grow from $30 billion in 2021 to $73 billion in 2027, a CAGR of 16.0%. To meet and address this growth, these fertility services practices must consider a partnership that will provide them with the scale, resources, expanded service lines, and geographic reach to keep their competitive advantage in today’s changing market.

Fertility Services Market Overview

The fertility services market continues to experience significant consolidation with several add-on acquisitions closing in each year since the industry’s first platform was established in 2015. As of 2023, there are nine private equity-backed fertility services platforms that are actively making investments across the United States.

Recent Fertility Services M&A Activity

Recent trends in the fertility services sector have showcased an increase in mergers and acquisitions (M&A) activities, reflecting a dynamic landscape of strategic partnerships and consolidation. These activities are reshaping the industry and creating innovative approaches to delivering fertility services and treatments.

Fertility Services Macroeconomic Trends

Due to positive macroeconomic trends, Westcove anticipates a sustained increase in private equity investment into fertility services. This demand is expected to grow for several reasons. Lifestyle factors such as later childbearing age as well as increased obesity and infertility for both men and women will increase demand and require fertility providers to expand their service offerings. In parallel, fertility service providers will benefit from both government and employer-expanded coverage for fertility treatments, which further promotes this already highly recession-resistant healthcare sector.

Lifestyle Factors: Later Childbearing, Increased Obesity, and Infertility

Women choosing to have children at later ages is a large contributing factor behind the growth of the fertility market. The average age for giving birth in 2022 is 30 years old compared to 21.4 years old in 1970. Delayed childbearing has become more common due to factors such as career pursuits, education, and financial stability. As a result, many individuals and couples are seeking fertility treatments to overcome age-related fertility challenges.

The adult obesity rate is determined by the Body Mass Index (BMI). A BMI of 30 and over is considered medically obese and a BMI of 35 and over is considered severely obese. More than 2 in 3 women in the United States are considered overweight or obese. Overweight and obese women have higher levels of hormonal imbalance which can lead to reduced fertility. Excess abdominal fat is linked to insulin resistance which can affect the regularity of menstrual cycles. Women with a BMI above 27 are three times more likely than women in the normal weight range to be unable to conceive because they cannot ovulate. This increases the need for fertility services to address the increase in adult obesity.

According to the World Health Organization, 48 million couples and 186 million individuals suffer from infertility annually, thus driving the logical demand for fertility services. In a recent survey conducted by RESOLVE: The National Infertility Association, 54% of respondents stated that they would consider seeing a fertility specialist if they had trouble conceiving. Greater awareness about infertility and available treatment options has reduced the stigma surrounding fertility services and encouraged more people to seek assistance, boosting the overall demand.

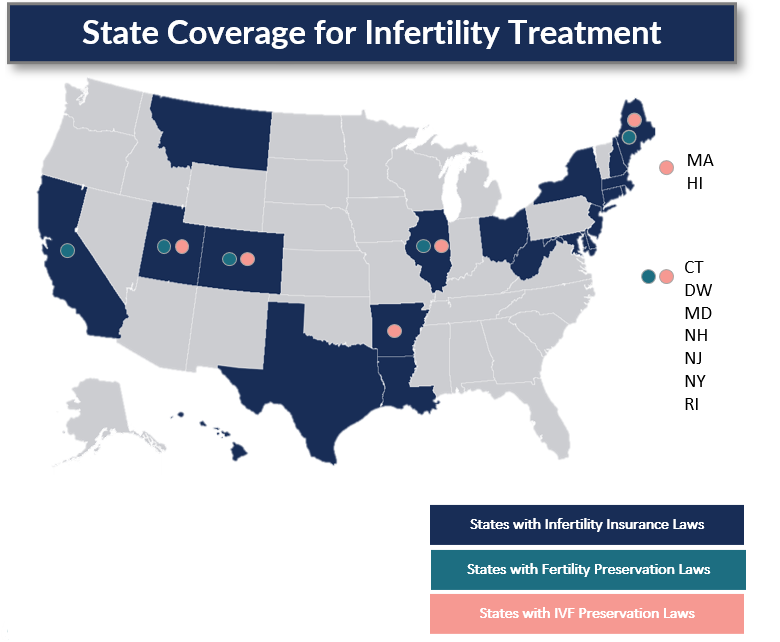

Expanded Healthcare Coverage

Fertility services providers are continuing to adapt to regulatory changes as statewide mandates call for government payors to offer coverage for infertility treatments. As of 2022, 20 states have passed fertility insurance coverage laws, greatly increasing the access for patients to receive fertility services across the United States.

In 2021, there was an 8% year-over-year increase in the number of large companies offering or enhancing family-building benefits. Additionally, 42% of large companies, defined as 20,000 or more employees, covered in vitro fertilization (IVF) in 2020 with 19% of large companies covering egg freezing. Among smaller companies with over 500 employees, 27% offered coverage for IVF treatment in 2020. According to Mercer’s Employer Benefit Report, the top three reasons employers are covering infertility treatment are to “ensure employees have access to quality, cost-effective care,” “stay competitive to recruit and retain top talent,” and “be recognized as a family-friendly employer”. These benefits have expanded access to fertility services to a wider audience and is contributing to the sector’s continued organic growth.

Highly Recession Resistant

Fertility services is highly recession-resistant as demand is often driven by the parents’ desire to build a family and the biological clocks of women. In the wake of the COVID-19 pandemic, the U.S. saw an increase in childbirths, particularly driven by college-educated women between the ages of 30 and 34. Many of these women were first-time college-educated mothers who benefited from increased flexibility in their work schedules and the ability to work from home. Additionally, while patients can sometimes choose to utilize their health insurance to cover some fertility services, more than half of these services continue to be paid out-of-pocket by patients. This further confirms the recession-resistance of fertility services as it is ultimately driven by the individual.

Private Equity Partnership Rationale in Fertility Services

There are several additional attractive factors from private equity’s perspective in addition to the favorable demographic and macroeconomic trends. Following the continued interest and consolidation in fertility services by private equity, Westcove expects additional new platforms to be created and additional add-on acquisitions to occur in the near- and long-term future.

Fragmented Market Ripe for Consolidation

The market’s fragmentation offers opportunities for consolidation and operational improvements, which can lead to enhanced profitability. Smaller fertility services practices often lack the resources and infrastructure to compete effectively, making them potential targets for acquisition by larger entities. While there are over 450 fertility clinics in the United States, only 135 fertility clinics perform over 500 IVF cycles annually with 70 of those fertility clinics performing more than 1000 IVF cycles annually, illustrating a high degree of fragmentation in the market.

High Margin Growth Profle

Fertility services often command high margins due to the specialized nature of treatments and the emotional significance attached to these services. The average cost of a single IVF cycle in the United States ranges from $12,000 to $20,000, with additional expenses for medications and other procedures. More so, the average patient will undergo three or more IVF cycles before a successful outcome, which illustrates the recurring nature of fertility services’ revenue.

Technology Advancements

Rapid advancements in assisted reproductive technologies (ART), such as IVF, intracytoplasmic sperm injection (ICSI), and preimplantation genetic testing (PGT), have significantly improved success rates and expanded the scope of fertility treatments. According to the CDC, the success rates of ART procedures have been steadily increasing over the years, with the live birth rate per ART cycle ranging from 21% to 29% depending on the woman’s age group. Additionally, the integration of artificial intelligence and big data analytics in fertility treatments has the potential to optimize patient outcomes and improve clinic efficiency.

The fertility services industry is experiencing significant growth and transformation, driven by changing demographics, advancements in technology, and growing acceptance of alternative family-building methods. The consolidation trend in the market and the increasing interest of private equity firms highlight the sector’s resilience and potential for continued expansion.

As the market continues to evolve, it is essential for stakeholders to adapt to changing patient needs, newly emerging technologies, and evolving regulatory landscapes to ensure the best possible outcomes for individuals and couples seeking fertility services. Moreover, continuous research and development efforts, along with strategic partnerships, will be critical in further advancing the field of fertility services and addressing the unique challenges faced by those struggling with infertility. By staying abreast of market trends and embracing innovation, fertility service providers can position themselves for sustained growth and success in the years to come.

Founder Considerations

Considering a Partnership

Considering a transaction is an immensely personal and impactful decision. Shareholders must consider multiple economic and interpersonal factors when deliberating when and how best to pursue a partnership. A group might be interested in partnering with a financial sponsor to pursue growth, consider retirement in the relatively near future, or want to mitigate the personal financial risk of having most of their wealth concentrated in their practice. Again, each shareholder’s decision is incredibly personal and is usually a combination of several factors.

Increased private equity interest in orthopedic services represents an opportunity for physician shareholders to seek access to growth capital and pursue personal financial risk mitigation with a tax-advantaged cash windfall. In contrast to traditional bank loans, private capital offers the flexibility to customize solutions according to the specific requirements of the business. It also fosters alignment of incentives among partners, facilitates financial diversification, and introduces enhanced expertise that was previously unavailable to orthopedic practice shareholders.

In a typical deal structure, private equity sponsors will typically make a control investment, greater than 50%, in a practice and invite shareholders to maintain rollover equity which is a percentage (e.g., 30% – 40%) of equity into the newly formed entity or platform practice. Additionally, shareholders no longer personally guarantee the financing of the Company. Other factors such as productivity, day-to-day management, and facilitating the growth of the newly formed entity become the primary concerns of the physician shareholders and management team, while the decisions are made by the clinical leaders of the organization. As this entity grows organically and through onboarding new physicians and additional practices; profitability increases through the realization of operational and administrative efficiencies. Physician shareholders participate in the growth through continued ownership in the platform entity, while not having to personally guarantee capital for growth. Shareholders often participate in the substantial appreciation of equity value in the platform entity upon a secondary recapitalization, or “second bite of the apple,” after what is typically a five-to-seven-year period. In conclusion, shareholders can monetize the hard-earned value they have achieved over their careers while reducing personal financial risk through asset (practice) diversification and pursuing broader growth strategies while meaningfully participating in the upside of such growth.

With a proven track record in M&A advisory services with more than $1 billion in aggregate transaction value generated, Westcove excels at orchestrating curated and competitive processes for physician practices. This ensures that founders and operators receive their deserved value for years of dedication to their patients, communities, and other stakeholders. Westcove’s pivotal role lies in preparing clients for success by offering strategic guidance, connecting them to an exclusive and carefully selected network of financial and strategic partners, and diligently managing the marketing process to secure optimal results in valuation and key deal terms.

Sources: Business Wire, Center for Disease Control, Centers for Medicare & Medicaid Services, Company websites, Healthcare Dealflow, Health Services Research, IBISWorld, MarketResearch, Mercer, RESOLVE, Research and Markets, PR Newswire, Statistica, World Health Organization.