Justin Hand

Managing Director

Orthopedic Industry Insights

Market Trends and M&A Activity

September 2023

Introduction

Orthopedic practices have seen increased levels of interest from private equity investors over the past several years. The primary trends that continue to fuel the industry’s consolidation include an aging U.S. population, the rise of adult obesity levels, the ongoing shift from inpatient to outpatient care settings, and the transition from fee-for-service to value-based payment models.

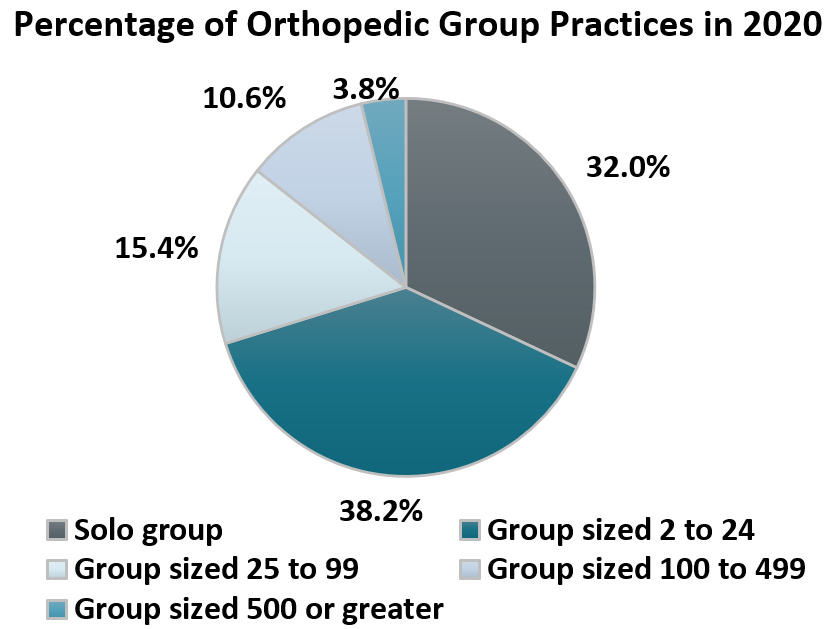

Orthopedic practices remain highly fragmented with 48% of surgeons working in private practices. Historically, consolidation in orthopedics has been driven by larger healthcare entities such as hospital systems and multispecialty surgical centers. However, the sector’s fragmentation, the flexibility of outpatient services and higher reimbursement rates in ambulatory surgery centers (“ASC”), as well as the potential for expanding ancillary services, make orthopedic practices incredibly attractive for private equity investment. The number of private equity firms investing in orthopedics has nearly doubled in recent years, as investors seek to establish their own platforms with forward-thinking orthopedic practices. Westcove expects these trends to continue to shape the industry well into 2023 and beyond.

Private equity investment provides orthopedic practices with new avenues for growth beyond the traditional route of partnering with health systems or multispecialty surgical centers. By accessing the capital and expertise of a private equity partner, these practices can grow through operational efficiencies such as improving revenue cycle management, consolidating IT and payroll, and offering additional ancillary services that smaller practices cannot typically support on their own. These consolidated platforms also aim to negotiate favorable payor contracts, which further benefits their operations. For leading practices, a private equity partner offers an opportunity to enhance their operations, share best practices, and provide improved care for a greater number of patients.

In the following white paper, Westcove will discuss these trends and detail why the subsequent years will be a dynamic time for forward-thinking orthopedic practices, as private equity continues to demonstrate significant interest and invests into the specialty.

Consolidation within Orthopedic Services

The orthopedic industry is highly fragmented and largely served by smaller, regional practices with five or fewer physicians. However, over the last decade, there has been a notable trend of consolidation, primarily fueled by regional health systems. Between 2010 and 2019, a total of 70 orthopedic practices in the United States were acquired, predominantly by larger healthcare entities such as hospital systems and multispecialty surgical centers. A partnership with a larger organization has enabled smaller orthopedic practices to expand service offerings and strengthen a practice’s ability to negotiate more favorable reimbursement rates, but these health system transactions often come at the detriment of independence and autonomy.

In 2017, private equity first entered the orthopedic space through Frazier Healthcare’s recapitalization of the Core Institute, which is now an affiliate of HOPCo, a platform backed by Linden Capital Partners and Audax Group. Since then, the frequency of deals has been rapidly increasing: the number of private equity firms investing in orthopedics has more than doubled from eight in 2020 to 17 in 2023. The influx of private equity investment will provide new growth opportunities for orthopedic practices, enabling them to expand both in size and scale beyond the traditional partnership route with health systems. With the rising demand for orthopedic treatments and procedures across the country, the global orthopedic market is projected to grow from $39 billion in 2021 to $50 billion by 2028. As a result, the trend of private equity firms seeking to invest in this specialty is anticipated to accelerate.

Orthopedic Market Overview

2023 Orthopedic Market Overview

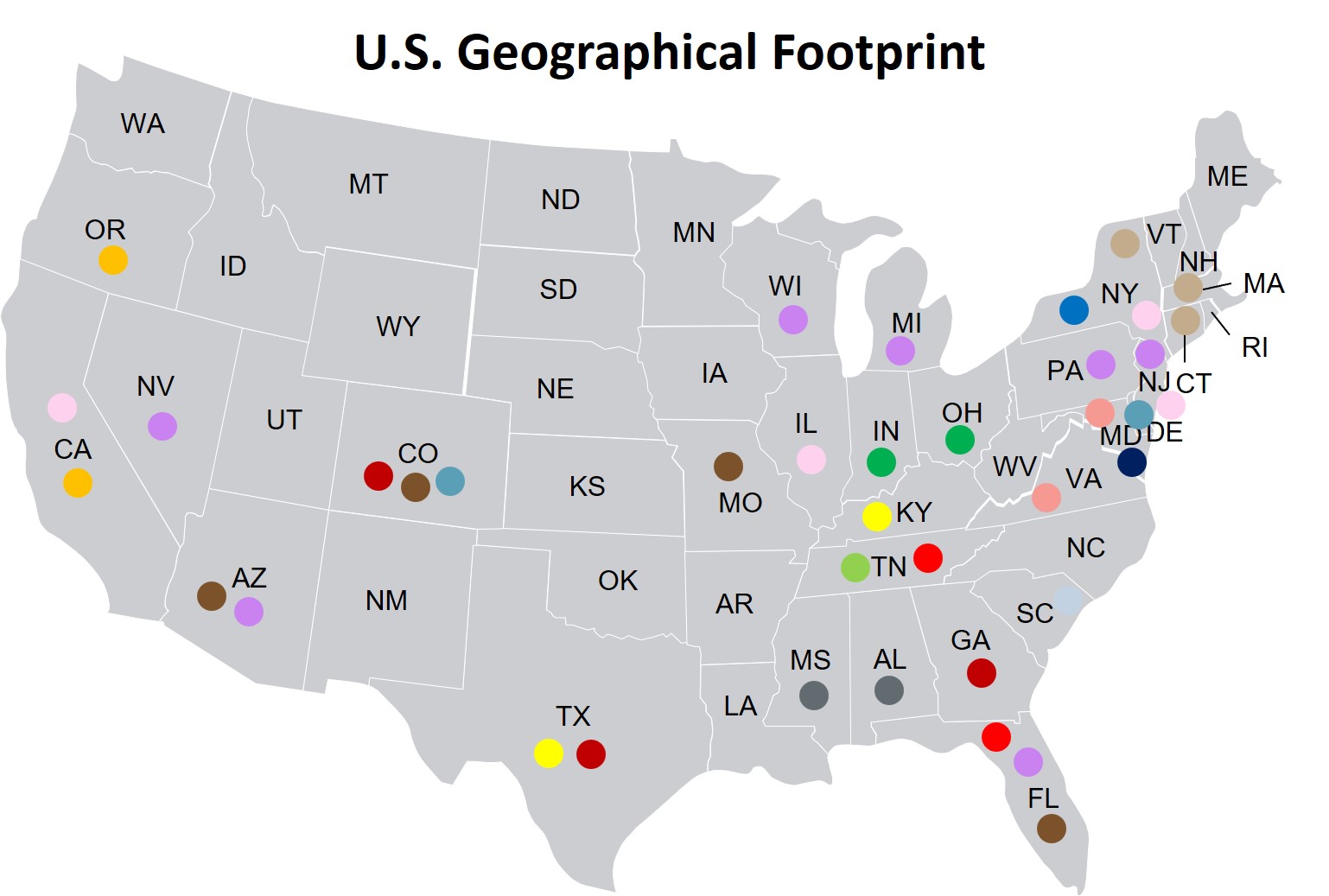

The orthopedic market continues to experience significant consolidation efforts with several add-on transactions closing year-over-year since the industry’s first platform was established in 2017 with the Core Institute’s partnership with Frazier Healthcare. As of 2023, there are 17 private equity-backed orthopedic platforms actively making investments across the United States. Strikingly, the Mid-Atlantic, Southeast, and Texas regions are experiencing the most significant M&A activity, following greater macroeconomic trends and population demographics to these regions. Below is an outline of the established orthopedic platforms across the United States. The following page outlines the most recent orthopedic transactions.

Recent Orthopedic M&A Activity

Recent trends in the orthopedic sector have showcased an increase in M&A activities, reflecting a dynamic landscape of strategic partnerships and consolidation. These activities are reshaping the industry and fostering innovative approaches to delivering orthopedic treatments and services.

Orthopedic Macroeconomic Trends

Favorable Demographic and Macroeconomic Trends

Due to promising macroeconomic trends, Westcove foresees a substantial influx of private equity investment into the orthopedic specialty. The demand for orthopedic services is expected to grow for several reasons. An aging population and rising adult obesity levels, in particular, will lead to a higher prevalence of joint and other musculoskeletal-related issues. Furthermore, the ongoing shift from inpatient to outpatient care settings, along with the transition from fee-for-service to value-based payment models, will collectively contribute to the growing demand for orthopedic services.

Aging Population

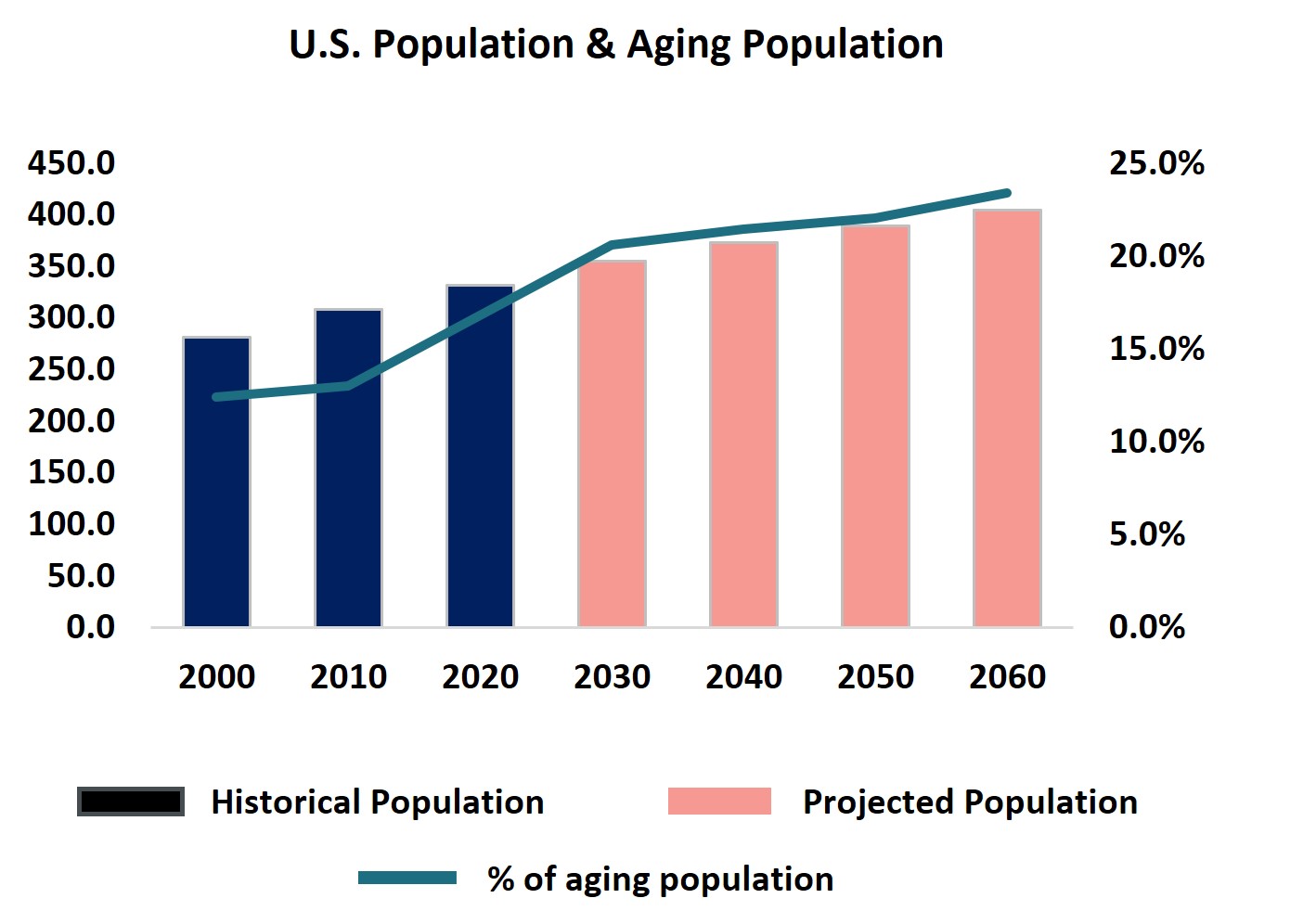

Orthopedic services are impacted by adults over the age of 65, with the average age of the U.S. population steadily increasing. In 2020, there were an estimated 56 million adults who were 65 or older, this age group is projected to reach 77 million and 90 million by 2035 and 2050, respectively. The increase of 21 million elderly individuals between 2020 and 2035 is primarily attributed to the aging baby boomer generation. By 2030, it is projected that one in five Americans will be age 65 or older, further contributing to the rise in demand for orthopedic services. As a result, there will be a direct and significant increase in the utilization of orthopedic services.

Adult Obesity Rate

The adult obesity rate is determined by the Body Mass Index (BMI). A BMI of 30 and over is considered medically obese and a BMI of 35 and over is considered severely obese. According to Johns Hopkins Arthritis Center, population-based studies have consistently shown that obesity is linked to musculoskeletal diseases, raising the risk of conditions like osteoarthritis and weight-induced joint problems. Data from the National Health and Nutrition Examination Survey (“HANES I”) found that those who have obesity (with a BMI between 30 and 35) are four to five times more likely to get arthritis in their knees. According to the Obesity and Knee Osteoarthritis: the Framingham Study, overweight individuals in their thirties who did not have knee osteoarthritis were at greater risk of later developing the disease. According to a study by Harvard T.H. Chan School of Public Health, the adult obesity rate will continue to rise, with nearly half of the U.S. population projected to be obese and about a quarter of the U.S. population to be severely obese by 2030. This anticipated increase in obesity is expected to lead to a higher demand and need for orthopedic services due to the potential rise in musculoskeletal issues.

Moving from the Inpatient to the Outpatient Setting

In 2020, the Center for Medicare and Medicaid Services (“CMS”) added total knee arthroplasty (TKA) to ASC-reimbursable procedures. In 2021, they expanded the list to include total hip replacements. CMS also revised its criteria, leading to Medicare covering 267 more musculoskeletal services in ASC settings. As a result of these changes, services that orthopedic surgeons can carry out in independent ASCs rather than hospitals are expected to rise. This shift may also act as an incentive for orthopedic surgeons who had previously relied on hospital employment to consider returning to independent practice with separate ASCs. These changes are set to transform the landscape of orthopedic surgical practices, promoting more procedures in the outpatient setting and providing new opportunities for surgeons in independent practice.

Value-based Care

Healthcare treatment has largely been fee-for-service, and physician practices have been incentivized by the frequency of visits and number of times a patient is treated. Payment models and payors are increasingly shifting towards value-based payment models that emphasize outcomes over frequency. This trend demands data analytics capabilities and increased care delivery standards. As orthopedic practices struggle to meet the demands of a continued shift towards value-based care, partnerships with orthopedic platforms will provide an alternative to joining a health system that is equipped to handle this overarching industry transition.

Private Equity Interest in Orthopedics

Private Equity Partnership Rationale in Orthopedics

There are several attractive traits in orthopedics from a private equity perspective in addition to the favorable demographic and macroeconomic trends. Following the recent interest and consolidation in orthopedics by private equity, Westcove expects additional new platforms to be created and additional add-on acquisitions to occur in the near and long term future.

Low Market Share Concentration with many Independent Practices

Orthopedic services has a low market share concentration and is primarily composed of practices of five or fewer physicians serving localized areas. The low concentration in orthopedic services leads to partnership opportunities amongst orthopedic practices to scale and improve efficiencies. By joining platforms backed by private equity firms, practices can create a cohesive organization by aligning with other clinically-minded groups. With scale and strength, the practices can garner greater leverage in payor negotiations as well as realize operational efficiencies by pooling administrative and technological resources.

Flexibility in Outpatient Settings along with ASC Reimbursement Increase

Relative to other services like gastroenterology, cardiology, and oncology, the flexibility of orthopedics makes the specialty favorable for private investment. CMS has approved additional procedures to be completed in the outpatient setting. This has resulted in private practices performing these additional procedures that historically needed to be done in the inpatient setting to now be performed in the outpatient setting. The ASC and outpatient setting allow practices to deliver patient satisfaction and cost savings effectively and efficiently. Consequently, this trend will drive growth and increase margins for these independent practices in the coming years.

Growth Opportunities for a Full Spectrum of Care that Invite Partnerships

Another identified area of growth for orthopedic practices is to provide patients with the full spectrum of care, such as diagnostic imaging and physical therapy in addition to traditional orthopedic services. It typically demands significant capital to build the facilities necessary to provide such a full spectrum of care, many orthopedic practices decided to collaborate with partners to navigate the evolving competitive landscape.

Private equity’s impact on orthopedic services has grown from its infancy since 2017, largely stemming from the autonomy that private equity firms can provide to physicians in contrast to other parties like hospitals and health systems. Consequently, more partnerships and alliances are expected to form through additional consolidation in the orthopedic market, investment into outpatient ASCs, and the ambition to provide a full spectrum of care to patients.

Founder Considerations

Considering a Partnership

Considering a transaction is an immensely personal and impactful decision. Shareholders must consider multiple economic and interpersonal factors when deliberating when and how best to pursue a partnership. A group might be interested in partnering with a financial sponsor to pursue growth, consider retirement in the relatively near future, or want to mitigate the personal financial risk of having most of their wealth concentrated in their practice. Again, each shareholder’s decision is incredibly personal and is usually a combination of several factors.

Increased private equity interest in orthopedic services represents an opportunity for physician shareholders to seek access to growth capital and pursue personal financial risk mitigation with a tax-advantaged cash windfall. In contrast to traditional bank loans, private capital offers the flexibility to customize solutions according to the specific requirements of the business. It also fosters alignment of incentives among partners, facilitates financial diversification, and introduces enhanced expertise that was previously unavailable to orthopedic practice shareholders.

In a typical deal structure, private equity sponsors will typically make a control investment, greater than 50%, in a practice and invite shareholders to maintain rollover equity which is a percentage (e.g., 30% – 40%) of equity into the newly formed entity or platform practice. Additionally, shareholders no longer personally guarantee the financing of the Company. Other factors such as productivity, day-to-day management, and facilitating the growth of the newly formed entity become the primary concerns of the physician shareholders and management team, while the decisions are made by the clinical leaders of the organization. As this entity grows organically and through onboarding new physicians and additional practices; profitability increases through the realization of operational and administrative efficiencies. Physician shareholders participate in the growth through continued ownership in the platform entity, while not having to personally guarantee capital for growth. Shareholders often participate in the substantial appreciation of equity value in the platform entity upon a secondary recapitalization, or “second bite of the apple,” after what is typically a five-to-seven-year period. In conclusion, shareholders can monetize the hard-earned value they have achieved over their careers while reducing personal financial risk through asset (practice) diversification and pursuing broader growth strategies while meaningfully participating in the upside of such growth.

With a proven track record in M&A advisory services with more than $1 billion in aggregate transaction value generated, Westcove excels at orchestrating curated and competitive processes for physician practices. This ensures that founders and operators receive their deserved value for years of dedication to their patients, communities, and other stakeholders. Westcove’s pivotal role lies in preparing clients for success by offering strategic guidance, connecting them to an exclusive and carefully selected network of financial and strategic partners, and diligently managing the marketing process to secure optimal results in valuation and key deal terms.

Sources: Ambulatory Surgery Center Association, American Academy of Orthopedic Surgeons, Arthrosc Sports Med Rehabil, Becker’s ASC Review, Becker’s Orthopedic Review, Becker’s Spine Review, Business Wire, CDC Data, CMS, Company websites, Harvard T.H. Chan School of Public Health & Cleveland Clinic, Healthcare Dealflow, Health Services Research, IBISWorld, Johns Hopkins Arthritis Center, Journal of the American Academy of Orthopaedic Surgeons, National Health and Nutrition Examination Survey, PR Newswire, RRY Publications, Stratview Research, U.S. Census Bureau